Overhead Costs and Dropping a Product Line The company manufactures three products. Profit computations for these three

Question:

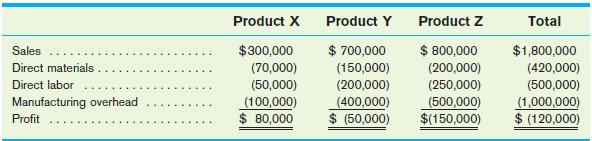

Overhead Costs and Dropping a Product Line The company manufactures three products. Profit computations for these three products for the most recent year are as follows:

The company traditionally allocates manufacturing overhead based on the level of direct labor cost—$2 of manufacturing overhead are allocated for each $1 of direct labor cost. However, of the company’s $1,000,000 in manufacturing overhead costs, $700,000 is directly related to the number of product batches produced during the year. The number of batches of the three products for the year was as follows: Product X, 20 batches; Product Y, 30 batches; Product Z, 50 batches. The remaining $300,000 in overhead is for facility support (property taxes, security costs, general administration, and so forth).

As you can see, the total company loss is $120,000. In an effort to reduce or eliminate this loss, the company has decided to drop Product Z. What would total company profit (or loss) have been in the most recent year if Product Z had been dropped at the beginning of the year?

Step by Step Answer:

Accounting Concepts And Applications

ISBN: 9780324376159

10th Edition

Authors: W. Steve Albrecht, James D. Stice, Earl K. Stice, Monte R. Swain