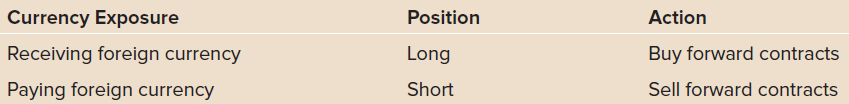

In regard to the table that Dr. Miles constructed, which of the following is true? a. The

Question:

a. The receiving foreign currency position is correct; the action is incorrect.

b. The receiving foreign currency position is incorrect; the action is also incorrect.

c. The paying foreign currency position is correct; the action is also correct.

Jackson Inc. is a multinational company based in West Point, Mississippi, that makes freight cars. One-third of Jackson€™s sales occur in the Netherlands. To manufacture the cars, the firm must import approximately half of the raw materials from Canada.

Two months from now, Jackson plans to sell freight cars to a Dutch firm for ‚¬15 million. To protect the company from any adverse moves in exchange rates, Jackson enters into a ‚¬15 million futures contract due in 60 days. Jackson also enters into a 60-day futures contract to lock in C$8.5 million, which will be used to purchase steel from a supplier.

The current euro to U.S. dollar exchange rate is ‚¬0.79/$ while the Canadian dollar to U.S. dollar exchange rate is C$1.30/$. The 60-day euro to U.S. dollar rate is ‚¬0.80/$, while the Canadian dollar to U.S. dollar rate is C$1.33/$. At the end of the two months, the actual euro to U.S. dollar exchange rate

is ‚¬0.90/$ and the actual Canadian dollar to U.S. dollar rate is C$1.20/$.

To help understand the relationships, Jackson€™s chief risk officer, Dr. Charles Miles, has put together the following table on hedging currency positions:

The value of one currency for the purpose of conversion to another. Exchange Rate means on any day, for purposes of determining the Dollar Equivalent of any currency other than Dollars, the rate at which such currency may be exchanged into Dollars...

Step by Step Answer:

Fundamentals of Investments, Valuation and Management

ISBN: 978-1259720697

8th edition

Authors: Bradford Jordan, Thomas Miller, Steve Dolvin