Regarding conditional prepayment rates (CPRs) and single monthly mortality (SMM) rates, which of the following is most

Question:

a. SMM is computed from the CPR to compute monthly prepayments.

b. SMM is computed from the CPR to compute changes in loan maturity.

c. CPR is computed from the SMM to compute monthly prepayments.

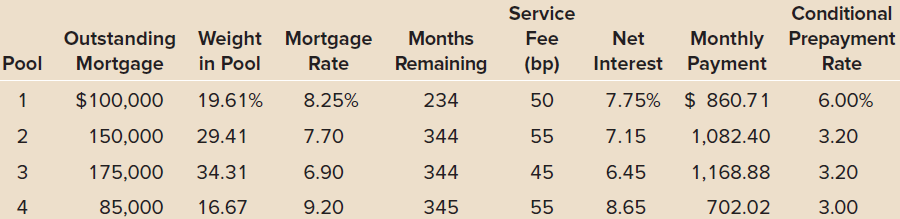

Mark Houston, a level 1 CFA candidate, has just been hired as a junior analyst in the mortgage-management department of Fixed Income Strategies. Mr. Houston is asked to perform some analysis on the mortgage pool shown below. All mortgages are conforming 30-year fixed-rate loans.

Before tackling the job, Mr. Houston does some research on mortgage loans. First, he assembles some facts about the difference between fixed-rate mortgage loans and traditional fixed-income corporate bonds:

Before tackling the job, Mr. Houston does some research on mortgage loans. First, he assembles some facts about the difference between fixed-rate mortgage loans and traditional fixed-income corporate bonds:

- Mortgage loan payments consist of both principal and interest.

- The final payment on a mortgage does not include the par amount of the loan.

- Servicing fees on mortgage pools decline as the loan matures.

- Straight corporate bonds do not include call options.

Marvin Blanda, CFA, CEO of Fixed Income Strategies, tells Mr. Houston to calculate the expected prepayments for the first 12 months for all of the loans in the portfolio. He warns Mr. Houston not to forget about the relationship between conditional prepayment rates (CPRs) and single monthly mortality (SMM) rates.

Step by Step Answer:

Fundamentals of Investments, Valuation and Management

ISBN: 978-1259720697

8th edition

Authors: Bradford Jordan, Thomas Miller, Steve Dolvin