On January 1, 2024, Perini Company purchased an 85% interest in Silvas Company for $400,000. On this

Question:

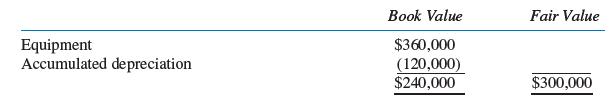

On January 1, 2024, Perini Company purchased an 85% interest in Silvas Company for $400,000. On this date, Silvas Company had common stock of $90,000 and retained earnings of $210,000. An examination of Silvas Company’s assets and liabilities revealed that their book value was equal to their fair value except for the equipment.

The equipment had an expected remaining life of six years and no salvage value. Straight- line

depreciation is used.

During 2024 and 2025, Perini Company reported net income from its own operations of $80,000 and paid dividends of $50,000 in each year. Silvas Company had income of $40,000 each year and paid dividends of $30,000 on each December 31. Accumulated depreciation is presented on a separate row in the workpaper and in the consolidated financial statements.

Required:

A. Prepare eliminating entries for consolidated financial statements workpaper for the year ended December 31, 2024, assuming:

1. The cost method is used to account for the investment.

2. The partial equity method is used to account for the investment.

B. On January 1, 2024, Silvas Company sold all its equipment for $220,000. Prepare the eliminating entries for the consolidated financial statements workpaper for the year ended December 31, 2024, assuming:

1. The cost method is used to account for the investment.

2. The partial equity method is used to account for the investment.

Step by Step Answer: