Suppose you observe the following situation: a. Calculate the expected return on each stock. b. Assuming the

Question:

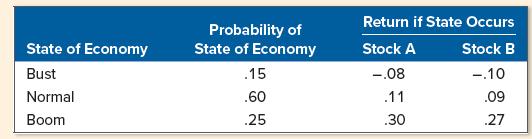

Suppose you observe the following situation:

a. Calculate the expected return on each stock.

b. Assuming the capital asset pricing model holds and Stock A’s beta is greater than Stock B’s beta by .35, what is the expected market risk premium?

Transcribed Image Text:

Return if State Occurs Probability of State of Economy State of Economy Stock A Stock B Bust .15 -.08 -.10 Normal .60 .11 .09 Boom .25 .30 .27

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 71% (7 reviews)

a The expected return on each stock can be calculate...View the full answer

Answered By

DHRUV RAI

As a tutor, I have a strong hands-on experience in providing individualized instruction and support to students of all ages and ability levels. I have worked with students in both one-on-one and group settings, and I am skilled in creating engaging and effective lesson plans that meet the unique needs of each student.

I am proficient in using a variety of teaching techniques and approaches, including problem-based learning, inquiry-based learning, and project-based learning. I also have experience in using technology, such as online learning platforms and educational software, to enhance the learning experience for my students.

In addition to my teaching experience, I have also completed advanced coursework in the subjects that I tutor, including mathematics, science, and language arts. This has allowed me to stay up-to-date on the latest educational trends and best practices, and to provide my students with the most current and effective teaching methods.

Overall, my hands-on experience and proficiency as a tutor have equipped me with the knowledge, skills, and expertise to help students achieve their academic goals and succeed in their studies.

0.00

0 Reviews

10+ Question Solved

Related Book For

Fundamentals Of Corporate Finance

ISBN: 9781265553609

13th Edition

Authors: Stephen Ross, Randolph Westerfield, Bradford Jordan

Question Posted:

Students also viewed these Business questions

-

Suppose you observe the following situation: Assume these securities are correctly priced. Based on the CAPM, what is the expected return on the market? What is the risk-freerate? Security Oxy Co....

-

Suppose you observe the following 1-year interest rates, spot exchange rates and futures prices. Futures contracts are available on 10,000. How much risk-free arbitrage profit could you make on 1...

-

Suppose you observe the following situation: Assume these securities are correctly priced. Based on the CAPM, what is the expected return on the market? What is the risk-free rate? Security Pete...

-

How many gallons of mercury (sg = 13.54) would weigh the same as 5 gal of castor oil, which has a specific weight of 59.69 lb/ft 3 ?

-

A 50.0-mL sample of 0.0150 M Ag2SO4 is added to 25.0 mL of 0.0100 M PbCl2. What is the net ionic equation for the reaction that occurs? What are the concentrations of ions in the mixture at...

-

Ludwig Company, which normally operates a process costing system to account for the cost of the computers that it produces, has received a special order from a corporate client to produce and sell...

-

What are some qualitative factors that analysts should consider when evaluating a companys likely future financial performance? AppendixLO1

-

The following data represent the stock price for the Walt Disney Company at the end of each month in 2010. Construct a time-series plot and comment on any trends. What was the percent change in the...

-

QS 13-4 (Algo) Horizontal analysis LO P1 Compute the annual dollar changes and percent changes for each of the following accounts. (Decreases should be indicated with a minus sign. Round percent...

-

An electric power distributor charges residential customers $0.10 per kilowatt-hour (kWh). The company advertises that "green power" is available in 150 kWh blocks for an additional $4 per month....

-

The Tribiani Co. just issued a dividend of $2.90 per share on its common stock. The company is expected to maintain a constant 4.5 percent growth rate in its dividends indefinitely. If the stock...

-

Suppose you observe the following situation: Assume these securities are correctly priced. Based on the CAPM, what is the expected return on the market? What is the risk-free rate? Expected Security...

-

Section 7(a)(2) of the Endangered Species Act of 1973 (ESA) is intended to protect species of animals against threats to their continuing existence caused by humans. The ESA instructs the Secretary...

-

An employer has calculated the following amounts for an employee during the last week of June 2021. Gross Wages $1,800.00 Income Taxes $414.00 Canada Pension Plan $94.00 Employment Insurance $28.00...

-

Section Two: CASE ANALYSIS (Marks: 5) Please read the following case and answer the two questions given at the end of the case. Zara's Competitive Advantage Fashion houses such as Armani and Gucci...

-

The activity of carbon in liquid iron-carbon alloys is determined by equilibration of CO/CO2 gas mixtures with the melt. Experimentally at PT = 1 atm, and 1560C (1833 K) the equilibrated gas...

-

Apply knowledge of concepts and theories covered in the course to leader - the leader can either be themselves if they lead a team, someone real and personally known to them (such as a boss or leader...

-

A resistor in a dc circuit R = 1.2 2. The power dissipated P is a second-degree function of the voltage V. Graph P versus V from V = 0.0 V to V = 3.0 V.

-

The following amortization schedule is for Flagg Ltd.?s investment in Spangler Corp.?s $100,000, five-year bonds with a 7% interest rate and a 5% yield, which were purchased on December 31, 2019, for...

-

Uniform electric field in Figure a uniform electric field is directed out of the page within a circular region of radius R = 3.00 cm. The magnitude of the electric field is given by E = (4.50 x 10-3...

-

Barnes Enterprises has bonds on the market making annual payments, with 12 years to maturity, a par value of $1,000, and a price of $963. At this price, the bonds yield 6.14 percent. What must the...

-

Stein Co. issued 15-year bonds two years ago at a coupon rate of 5.4 percent. The bonds make semiannual payments. If these bonds currently sell for 94 percent of par value, what is the YTM?

-

Volbeat Corporation has bonds on the market with 10.5 years to maturity, a YTM of 6.2 percent, a par value of $1,000, and a current price of $945. The bonds make semiannual payments. What must the...

-

An 8%, 30-year semi-annual corporate bond was recently being priced to yield 10%. The Macaulay duration for this bond is 10.2 years. What is the bonds modified duration? How much will the price of...

-

Question 7 of 7 0/14 W PIERDERY Current Attempt in Progress Your answer is incorrect Buffalo Corporation adopted the dollar value LIFO retail inventory method on January 1, 2019. At that time the...

-

Cost of debt with fees . Kenny Enterprises will issue a bond with a par value of $1,000, a maturity of twenty years, and a coupon rate of 9.9% with semiannual payments, and will use an investment...

Study smarter with the SolutionInn App