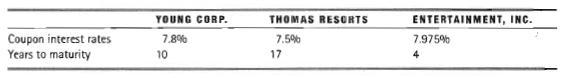

Following you will find data on $1,000 par value bonds issued by Young Corporation, Thomas Resorts, and

Question:

Following you will find data on $1,000 par value bonds issued by Young Corporation, Thomas Resorts, and Entertainment, Inc. at the end of2003. Assume you are thinking about buying these bonds as ofjanuary 2004. Answer the following questions for each of these bonds:

1. Calculate the values of the bonds if your required rates ofreturn are as follows: Young Corp., 6 percent; Thomas Resorts, 9 percent; and Entertainment, Inc., 8 percent:

2. In December 2003, the bonds were selling for the following amounts:

Young Corp. $1,030 Thomas Resorts $ 973 Entertainment, Inc. $1,035 What were the expected rates of return for each bond?

3. How would the values of the bonds change if (I) your required rate of return (k) increases 3 percentage points or (il) your required, rate of return (k) decreases 3 percentage points?

4. Explain the implications of your answers in questions 2 and 3 as they relate to interest rate risk, premium bonds, and discount bonds.

5. Compute the duration for each of the bonds. Interpret your results.

6. What are some of the things you can conclude from these computations?

7. Should you buy the bonds? Explain.

Step by Step Answer:

Financial Management Principles And Applications

ISBN: 9780131450653

10th Edition

Authors: Arthur J. Keown, J. William Petty, John D. Martin, Jr. Scott, David F.