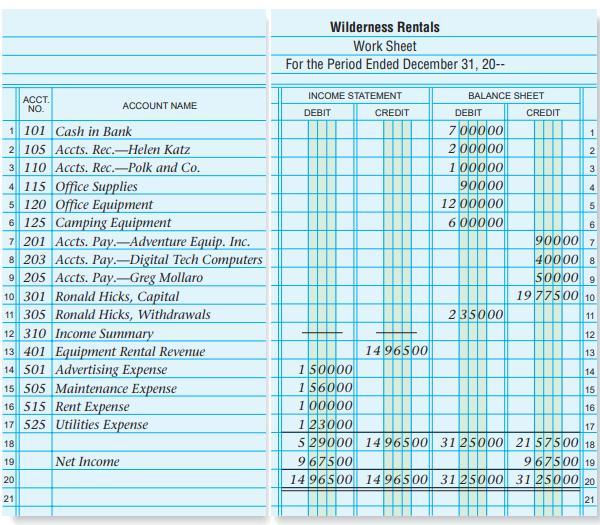

A portion of the work sheet for Wilderness Rentals for the period ended December 31 follows. Using

Question:

A portion of the work sheet for Wilderness Rentals for the period ended December 31 follows.

Using the information from the work sheet, prepare the journal entries to close the temporary accounts.

1. Record the closing entry for the revenue account.

2. Record the closing entry for the expense accounts.

3. Record the closing entry for the Income Summary account.

4. Record the closing entry for the withdrawals account.

ACCT. NO. ACCOUNT NAME 1 101 Cash in Bank 2 105 Accts. Rec.-Helen Katz 3 110 Accts. Rec.-Polk and Co. 4 115 Office Supplies 5 120 Office Equipment 6 125 Camping Equipment 7 201 Accts. Pay-Adventure Equip. Inc. 8 203 Accts. Pay.-Digital Tech Computers 9205 Accts. Pay-Greg Mollaro 10 301 Ronald Hicks, Capital 11 305 Ronald Hicks, Withdrawals 12 310 Income Summary 13 401 Equipment Rental Revenue 14 501 Advertising Expense 15 505 Maintenance Expense 16 515 Rent Expense 17 525 Utilities Expense 18 19 Net Income 20 21 T Wilderness Rentals Work Sheet For the Period Ended December 31, 20-- INCOME STATEMENT DEBIT CREDIT BALANCE SHEET DEBIT 700000 200000 100000 90000 1200000 600000 235000 1496500 150000 156000 100000 123000 17 529000 1496500 3125000 2157500 18 967500 967500 19 14 96500 1496500 3125000 31 25000 20 21 T 115. CREDIT SAWN- N 5 90000 7 40000 8 50000 9 1977500 10 67892228 11 12 13 14 15 16

Step by Step Answer:

Related Video

A journal entry is an act of keeping or making records of any transactions either economic or non-economic. Transactions are listed in an accounting journal that shows a company\'s debit and credit balances. The journal entry can consist of several recordings, each of which is either a debit or a credit

Students also viewed these Business questions

-

The adjusted trial balance columns of the work sheet for Thao Company, owned by D. Thao, are as follows. Instructions (a) Prepare closing entries. (b) Use T accounts to post the closing entries and...

-

The completed financial statement columns of the work sheet for Bray Company are available. Instructions (a) Prepare an income statement, a statement of owner's equity, and a classified balance...

-

A portion of the work sheet of Sadies Flowers for the year ended December 31 is as follows: Required 1. Determine the entries that appeared in the Adjustments columns and present them in general...

-

Accurate Job Costing must be done on three levels. Which of the following is not one of these levels? Tracking and controlling costs during jobs Tracking gross profit each month Filing records on...

-

Differentiate between defined contribution pension plans and defined benefit pension plans.

-

(a) What is a function? What are its domain and range? (b) What is the graph of a function? (c) How can you tell whether a given curve is the graph of a function?

-

Explain absorption costing.

-

1: Using variable elimination (by hand!), compute the probability that a student who did well on the test actually understood the material, that is, compute P(+u| + e). 2: For the above Bayesian...

-

picture 1 instructions picture 2 question poctiure 3 is just an example of how template should look Description For Excel Assignment #2 you will prepare an Excel spreadsheet to calculate the answer...

-

A long rod of 20-mm diameter and a thermal conductivity of 1.5 W/m K has a uniform internal volumetric thermal energy generation of 10 6 W/m3. The rod is covered with an electrically insulating...

-

Make the closing entries for (a) a $5,000 net income for the year ending December 31 and (b) a $4,000 net loss for the quarter ending June 30.

-

a . What is the source of information for the closing entries? b . List the steps for journalizing the closing entries.

-

Kamins Corporation has two bond issues outstanding, each with a par value of $1,000. Information about each is listed below. Suppose market interest rates rise 1 percentage point across the yield...

-

St. Cecilia's Health System's current culture may be defined by a blend of historical ideals and problems. Given its history of primarily caring for women and children, it is likely to place a...

-

For this assignment, imagine we are the supervisor of case managers who come to us for support and guidance. You have noticed a theme of questions that are frequently asked, which mostly surround...

-

Audio Partners needs to invest in the next level of technology in order to be competitive. The company is exploring the purchase of a new piece of equipment that will cost $1,500,000, at an expected...

-

Choose a real company of their choosing and will focus on ways to help increase the company's digital consumer engagements. For example, how can the company better drive increased revenue, sales,...

-

Four morally and ethically relevant principles have been examined regarding scarcity and include: Treating people with consistency through the use of a lottery or first-come first-served basis...

-

A restaurant menu has four kinds of soups, eight kinds of main courses, five kinds of desserts, and six kinds of drinks. If a customer randomly selects one item from each of these four categories,...

-

AB CORPORATION ISSUED THE FOLLOWING 850 COMMON STOCKS PAR VALUE P100 750 PARTICIPATING PREFERRED STOCKS PAR VALUE P100 AT 3% AB CORPORATION DECLARED P100,000.00 DIVIDEND IN 2022.

-

Give two examples of service firms that work with other channel specialists to sell their products to final consumers. What marketing functions is the specialist providing in each case?

-

Discuss some reasons why a firm that produces installations might use direct distribution in its domestic market but use intermediaries to reach overseas customers.

-

Explain discrepancies of quantity and assortment using the clothing business as an example. How does the application of these concepts change when selling steel to the automobile industry? What...

-

During the month of September,the Cider Pressing Company is trying to determine how much cider they are going to sell in October and November. One gallon of cider typically sells for $7 per gallon....

-

This is very confusing please help with descriptions if possible. Complete this question by entering your answers in the tabs below. Prepare a master budget for the three-month period ending June 30...

-

Doug recibe un dplex como regalo de su to. La base del to para el dplex y el terreno es de $90,000. En el momento de la donacin, el terreno y el edificio tienen un FMV de $40 000 y $80 000,...

Study smarter with the SolutionInn App