(Budgeting revenues) The following information relates to the prior- and current-year revenues of the General Fund of...

Question:

(Budgeting revenues)

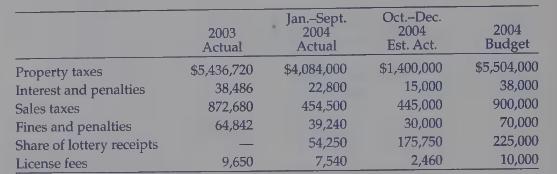

The following information relates to the prior- and current-year revenues of the General Fund of Bacchus City.

Jan.—Sept. Oct —Dec.

Jan.—Sept. Oct —Dec.

2003 ‘~~ 2004 2004 2004 Actual Actual Est. Act. Budget Property taxes $5,436,720 $4,084,000 $1,400,000 $5,504,000 Interest and penalties 38,486 22,800 15,000 38,000 Sales taxes 872,680 454,500 445,000 900,000 Fines and penalties 64,842 39,240 30,000 70,000 Share of lottery receipts a 54,250 175,750 225,000 License fees 9,650 7,540 2,460 10,000 Additional information:

1. Because of a reassessment of commercial property, property taxes are expected to increase by $400,000 in 2005.

2. Interest and penalties and license fees are expected to remain constant over the next several years.

3. Because of an increase in the sales tax from 4 percent to 5 percent and the expectation of several large conventions in 2005, sales tax revenues are expected to increase by 20 percent.

4. Because of the conventions mentioned in part (3), fines and penalties should rise by 10 percent in 2005.

5. Because of the lottery’s success in its first few months of operation, city officials expect the board’s share of the lottery receipts to double in 2005.

Required: Prepare a statement of actual and estimated revenues for 2005.

Assume that you are preparing it on October 15, 2004, and that the changes given above are with respect to the 2004 budget.

Step by Step Answer:

Introduction To Government And Not For Profit Accounting

ISBN: 9780130464149

5th Edition

Authors: Martin Ives, Joseph R. Razek, Gordon A. Hosch