2017 Jun. 10 Adam Buckner and Amber Kwan have agreed to pool their assets and form a...

Question:

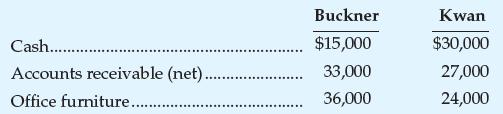

2017 Jun. 10 Adam Buckner and Amber Kwan have agreed to pool their assets and form a partnership to be called B&K Consulting. They agree to share all profits equally and make the following initial investments:

Dec. 31 The partnership’s reported net income was $195,000 for the year ended December 31, 2014.

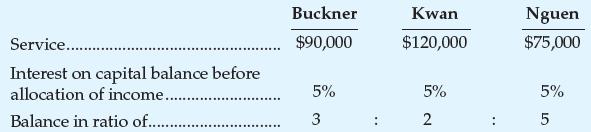

2018 Jan. 1 Buckner and Kwan agree to accept Heidi Nguen into the partnership with a $180,000 investment for 30 percent of the business. The partnership agreement is amended to provide for the following sharing of profits and losses:

Dec. 31 The partnership’s reported net income was $480,000. 2019

Oct. 10 Buckner withdrew $84,000 cash from the partnership and Kwan withdrew $57,000 (Nguen did not make any withdrawals).

Dec. 31 The partnership’s reported net income was $255,000. 2020

Jan. 2 After a disagreement as to the direction in which the partnership should be moving, Nguen decided to withdraw from the partnership. The three partners agreed that Nguen could take cash of $300,000 in exchange for her equity in the partnership.

Required

1. Journalize all of the transactions for the partnership.

2. Prepare the partners’ equity section of the B&K Consulting balance sheet as of January 2, 2020.

Step by Step Answer:

Horngrens Accounting

ISBN: 9780135359785

11th Canadian Edition Volume 2

Authors: Tracie Miller Nobles, Brenda Mattison, Ella Mae Matsumura, Carol A. Meissner, Jo Ann Johnston, Peter R. Norwood