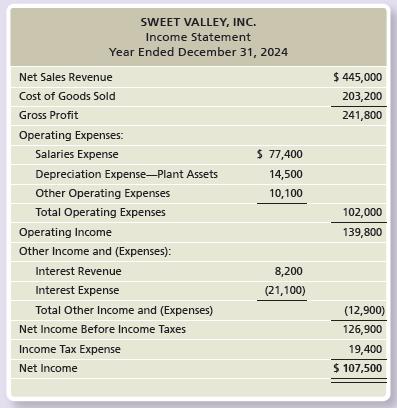

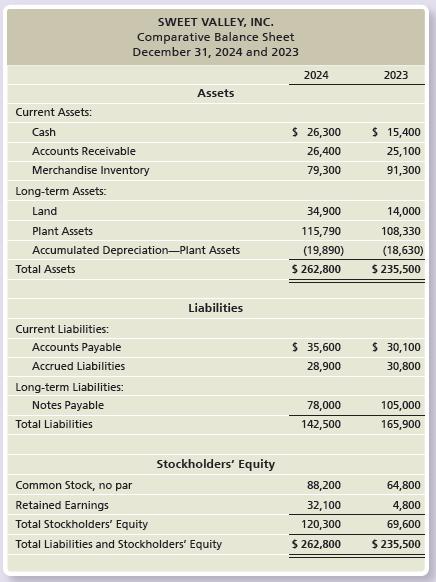

The 2024 income statement and comparative balance sheet of Sweet Valley, Inc. follow: Additionally, Sweet Valley purchased

Question:

The 2024 income statement and comparative balance sheet of Sweet Valley, Inc. follow:

Additionally, Sweet Valley purchased land of $20,900 by financing it 100% with long-term notes payable during 2024. During the year, there were no sales of land, no retirements of stock, and no treasury stock transactions. A plant asset was disposed of for $0. The cost and the accumulated depreciation of the disposed asset was $13,240. Plant asset was acquired for cash.

Requirements

1. Prepare the 2024 statement of cash flows, formatting operating activities by the indirect method.

2. How will what you learned in this problem help you evaluate an investment?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Horngrens Accounting The Financial Chapters

ISBN: 9780136162186

13th Edition

Authors: Tracie Miller Nobles, Brenda Mattison

Question Posted: