This problem continues the Canyon Canoe Company situation from Chapter F:15. Canyon Canoe Companys comparative balance sheet

Question:

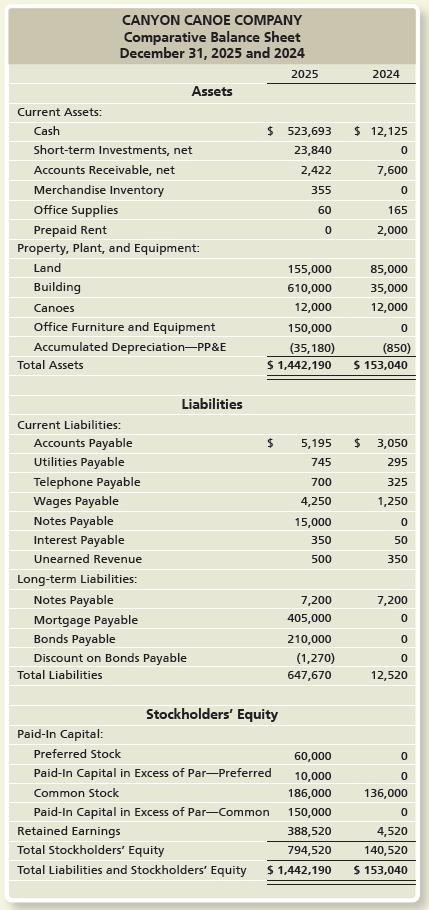

This problem continues the Canyon Canoe Company situation from Chapter F:15. Canyon Canoe Company’s comparative balance sheet is shown below. 2025 amounts are assumed, but include several transactions from prior chapters.

Additional data follow:

1. The income statement for 2025 included the following items:

a. Net income, $417,000.

b. Depreciation expense for the year, $34,330.

c. Amortization on the bonds payable, $254.

2. There were no disposals of property, plant and equipment during the year. All acquisitions of PP&E were for cash except the land, which was acquired by issuing preferred stock.

3. The company issued bonds payable with a face value of $210,000, receiving cash of $208,476.

4. The company distributed 4,000 shares of common stock in a stock dividend when the market value was $4.50 per share. All other dividends were paid in cash.

5. The common stock, except for the stock dividend, was issued for cash.

6. The cash receipt from the notes payable in 2025 is considered a financing activity because it does not relate to operations.

Requirement

Prepare the statement of cash flows for the year ended December 31, 2025, using the indirect method.

Step by Step Answer:

Horngrens Accounting The Financial Chapters

ISBN: 9780136162186

13th Edition

Authors: Tracie Miller Nobles, Brenda Mattison