Transfer prices, goal-congruence, capacity. The Bottle Division of Orange Fresh Inc. is i the only source of

Question:

Transfer prices, goal-congruence, capacity. The Bottle Division of Orange Fresh Inc. is i the only source of bottles to contain the orange flavour soda that is mixed, bottled, and pack- 9. Bottle Division costs aged by the Mixing Division to be sold in southern Ontario. A substantial part of the Bottle fr 4,000 units, $800 Division’s costs are fixed. For any output up to 1,000 bottles a day, its total costs are $500 a day. Total costs increase by $100 a day for every additional 1,000 bottles made. Bottle Division judges that its own results will be optimized if it sets its price at $0.40 a bottle, and it acts accordingly.

The Mixing Division incurs additional costs to mix, bottle, and pack the premium soda. These costs are $1,250 for any output up to 1,000 bottles, and $250 per thousand for outputs in excess of 1,000 bottles. On the revenue side, the Mixing Division can increase its revenue only by spending more on sales promotion and by reducing selling prices.

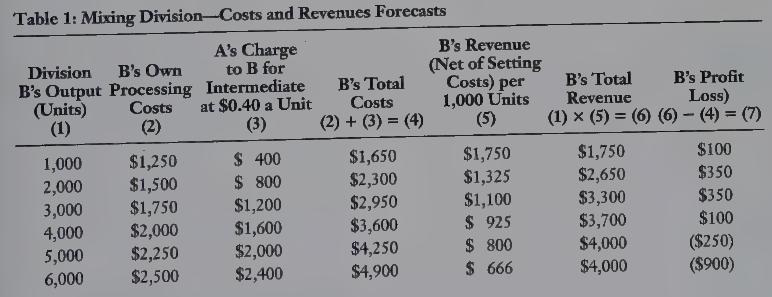

Table 1 compares the Mixing Division’s costs and revenues at various levels of output while considering both its own processing costs and what it is charged by the Bottle Division for the intermediates that it will supply. Table 1 makes it clear that the most profitable policy for the Mixing Division is to set its output at either 2,000 or 3,000 bottles a day and to accept a profit of $350 a day. If its output is more than 3,000 bottles or less than 2,000 bottles it will make less profit.

The Mixing Division decided to sell 3,000 bottles a day. The Bottle Division transfers each bottle at $0.40 making total revenues of $1,200 with total cost of $700. Therefore, the Bottle Division profit is $500 a day. Adding this to Mixing Division’s profit of $350 a day, Orange Fresh Inc. gets an aggregate profit of $850 a day.

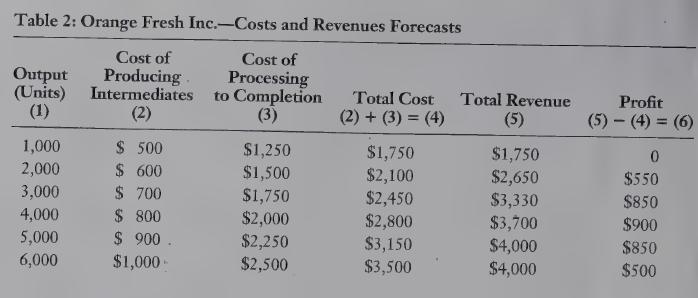

The controller of Orange Fresh Inc. was studying the company’s figures trying to find ways to maximize profit. The controller assumed that the company abandoned its divisionalized structure and, instead of having two profit centres, Bottle and Mixing, the two were combined into a single profit centre with responsibility for the complete processing.

The controller assumed that all the other conditions previously presented ne at continued to apply, and prepared a forecast of costs and revenues for the single gystems, WancenPhcn a :

profit centre as shown in Table 2.

INSTRUCTIONS Form groups of two or three students to complete the following requirements.

REQUIRED 1. What level of output maximizes Orange Fresh Inc.’s profit?

2. What is the lowest price that Bottle Division ghould be willing to accept from Mixing Division for 4,000 bottles?

3. What is the highest price at which Mixing Division should be willing to buy 4,000 bottles from Bottle Division?

4. If Bottle Division does sell 4,000 bottles to Mixing Division, what should be the transfer price?

5. Explain why the divisions were transferring 3,000 units between them.LO1

Step by Step Answer:

Cost Accounting A Managerial Emphasis

ISBN: 9780135004937

5th Canadian Edition

Authors: Charles T. Horngren, Foster George, Srikand M. Datar, Maureen P. Gowing