Lamden Company paid its employee, Trudy, wages of $52,000 in 2019. Calculate the FICA tax: Withheld from

Question:

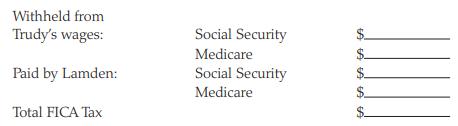

Lamden Company paid its employee, Trudy, wages of $52,000 in 2019. Calculate the FICA tax:

Transcribed Image Text:

Withheld from Trudy's wages: Social Security Medicare Paid by Lamden: Social Security Medicare Total FICA Tax

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 55% (9 reviews)

Trudy Lamden Company Total FICA T...View the full answer

Answered By

Jeff Omollo

As an educator I have had the opportunity to work with students of all ages and backgrounds. Throughout my career, I have developed a teaching style that encourages student engagement and promotes active learning. My education and tutoring skills has enabled me to empower students to become lifelong learners.

5.00+

5+ Reviews

52+ Question Solved

Related Book For

Income Tax Fundamentals 2020

ISBN: 9780357108239

38th Edition

Authors: Gerald E. Whittenburg, Martha Altus Buller, Steven Gill

Question Posted:

Students also viewed these Business questions

-

Lamden Company paid its employee, Trudy, wages of $47,000 in 2018. Calculate the FICA tax: Withheld from Trudy's wages: Social Security Medicare Paid by Lamden: Social Security $. Medicare Total FICA...

-

Fiduciary Investments paid its employee, Yolanda, wages of $139,000 in 2019. Calculate the FICA tax: Withheld from Yolanda's wages: Social Security Medicare $- Paid by Fiduciary: Social Security $....

-

Fidicuary Investments paid its employee, Yolanda, wages of $137,000 in 2018. Calculate the FICA tax: Withheld from Yolanda's wages: Social Security Medicare Paid by Fiduciary: Social Security...

-

Suppose that a client performs an intermixed sequence of push and pop operations on a pushdown stack. The push operations insert the integers 0 through 9 in order onto the stack; the pop operations...

-

What can organisations do to better integrate training and learning into core business functions? Discuss what organisational barriers exist to stop this from occurring.

-

What role should gambling firms such as Betfair have in dealing with this issue?

-

Let B1 and B2 be independent Brownian motions and dZ def = dZ1 dZ2 = 11 12 21 22dB1 dB2 def = AdB for stochastic processes ij, where A is the matrix of the ij. (a) Calculate a, b, and c with a >...

-

An electronics firm is currently manufacturing an item that has a variable cost of $.50 per unit and a selling price of $1.00 per unit Fixed costs are $14,000. Current volume is 30,000 units. The...

-

An advantage of corporations over sole proprietorships is that Select one lon O a Corporations are easier and less costly to form than sole proprietarships Ob. Corporations offer the greatest degree...

-

1. Compare the facts of the Modnick case with the facts of the Welch case provided in the memo to Terry Jacobs. What do the two cases have in common? How do the cases differ? 2. Are there additional...

-

Sherina Smith (Social Security number 785-23-9873) lives at 536 West Lapham Street, Milwaukee, WI 53204, and is self-employed for 2019. She estimates her required annual estimated tax payment for...

-

Thomas is an employer with two employees, Patty and Selma. Pattys wages are $12,450 and Selmas wages are $1,310. The state unemployment tax rate is 5.4 percent. Calculate the following amounts for...

-

Calculate materials and labor variances (Learning Objective 4) Dock Guard, which uses a standard cost accounting system, manufactured 200,000 boat fenders during the year, using 1,450,000 feet of...

-

At the Business Level there are a couple main strategies that companies use- Cost Leadership and Differentiation. What is the difference between them? Share some examples of companies or specific...

-

https://youtu.be/c_Eutci7ack After watching the video, what are your thoughts on Power? Would you want to have this Power ? Why would you not want this Power? If you are a manager or want to be a...

-

Find anti derivative of ( 2 t - 4 + 3 ^ ( 1 / 2 ) ) / t ^ ( 1 / 2 )

-

How Adidas is using creative narratives to build brand equity Adidas' outdoor division is drawing on the expertise of its wider athletic business while at the same time flexing its creative muscle to...

-

May I have a word" Alysha Stark popped her head in at the corner office of the Managing Director Mike O' Connor. It's early on a Monday morning. When Alysha, his star Director, starts something this...

-

Rationalize the denominator. 2/27

-

Show that the block upper triangular matrix A in Example 5 is invertible if and only if both A 11 and A 22 are invertible. Data from in Example 5 EXAMPLE 5 A matrix of the form A = [ A11 A12 0 A22 is...

-

Rebecca, a single taxpayer, owns a Series I U.S. Savings Bond that increased in value by $46 during the year. She makes no special election. How much income must Rebecca recognize this year? a. $0 b....

-

Rebecca, a single taxpayer, owns a Series I U.S. Savings Bond that increased in value by $46 during the year. She makes no special election. How much income must Rebecca recognize this year? a. $0 b....

-

How are qualified dividends taxed in 2018? Please give the rates of tax which apply to qualified dividends, and specify when each of these rates applies

-

Ventaz Corp manufactures small windows for back yard sheds. Historically, its demand has ranged from 30 to 50 windows per day with an average of 4646. Alex is one of the production workers and he...

-

Which of the following statements is not true regarding the $500 credit for dependent other than a qualifying child credit. Cannot be claimed on the same tax return if the child tax credit is also...

-

Grind Co. is considering replacing an existing machine. The new machine is expected to reduce labor costs by $127,000 per year for 5 years. Depreciation on the new machine is $57,000 compared with...

Study smarter with the SolutionInn App