Follow the step-by-step procedures provided to complete this problem for Keller Windows & Doors for the month

Question:

Step 1: Start Integrated Accounting 8e software.

Step 2: Open the file named IA8 Problem 10-A.

Step 3: Enter your name in the Your Name text box.

Step 4: Save the data to your disk with a file name of 10-A Your Name.

Step 5: Add Clark Company to the vendor list.

Step 6: Delete George Lentz from the customer list.

Step 7: Add Eric Reinhart to the customer list.

Step 8: Enter the following general journal transaction.

General Journal Transaction

Mar. 01

Prepare reversing entries required by February adjustments. Use the adjustment data presented in Sample Problem 10-S as the basis for your reversing entries. Enter Rev.Ent. in the Reference text box.

Step 9: Enter the purchase order and purchase invoice transactions.

Purchase Order and Purchase Invoice Transactions

Mar. 02

Ordered 28 Casement Crank€”Double windows at $380.00 each on account from Quade Corporation, terms 2/10, n/30. Purchase Order No. 1148.

06

Returned 1 Wood Entry Door€”Single at $895.00 to Gunderson, Inc. Purchase Invoice No. R2329.

14

Received 14 Picture Window€”Double at $625.00 each for Purchase Order No. 1145 from Quade Corporation, terms 2/10, n/30. Purchase Invoice. 2330.

22

Received 5 Wood Patio Door€”Double at $1,195.00 each for Purchase Order No. 1147 from Lancaster, Inc., terms 2/10, n/30. Purchase Invoice No. 2331.

26

Ordered 32 Casement Slider€”Double windows at $380.00 each on account from Paulson, Inc., terms 2/10, n/30. Purchase Order No. 1149.

31

Returned 1 Casement Slider€”Single window at $195.00 to Neubert Corporation. Purchase Invoice No. R2307.

Step 10: Enter the cash payments transactions.

Cash Payments Transactions

Mar. 02

Paid cash for heating and lighting expense, $1,107.45. Check No. 7215.

05

Paid cash for monthly telephone bill, $798.62. Check No. 7216.

16

Paid cash on account to Quade Corporation, $8,750.00, less 2% discount for window merchandise, $175.50. Check No. 7217.

17

Paid cash on account to Tollefson Corporation, $5,000.00, less 2% discount for door merchandise, $100.00. Check No. 7218.

21

Paid cash for advertising, $350.00. Check No. 7219.

24

Paid on account to Neubert Corporation, $289.40, no discount. Check No. 7220.

30

Paid cash for monthly salaries: sales salaries, $10,320.00; administrative salaries, $4,026.00; total $14,346.00. Check No. 7221.

30

Paid cash for monthly rent, $2,825.00. Check No. 7222.

31

Paid cash for sales tax liability, $586.80. Check No. 7223.

Step 11: Enter the sales invoices transactions.

Sales Invoices Transactions

Mar. 02

Sold 17 Casement Slider€”Double windows at $769.00 each, and 3 Wood Entry Door€”Single at $1,895.00 to Bickell Construction Co., terms 2/10, n/30, no sales tax. Sales Invoice No. 4637.

04

Granted credit to Bickell Construction Co. for 1 Casement Slider€” Double window at $769.00, no sales tax. Sales Return No. R4637.

05

Sold 1 Wood Entry Door€”Double at $3,500.00, 3 Garage Fire Doors at $425.00, 12 Casement Crank€”Double windows at $769.00 each, and 1 Therm. Patio Door€”Double at $1,995.00 to Quality Contractors, terms 2/10, n/30, no sales tax. Sales Invoice No. 4638.

09

Granted credit to Quality Contractors for 1 Garage Fire Door at $425.00, no sales tax. Sales Return No. R4638.

15

Sold 1 Wood Patio Door€”Double at $2,450.00, and 6 Casement Crank€”Single windows at $395.00 to Phillip Gilbert, terms 30 days, 6% sales tax. Sales Invoice No. 4639.

18

Sold 16 Casement Crank€”Double windows at $769.00 each, 2 Casement Picture€”Bay windows at $1,495.00, 1 Wood Entry Door€”Single at $1,895.00, and 3 Vinyl Patio Door€”Single at $645.00 to Penkhus Remodeling, Inc., terms 2/10, n/30, no sales tax. Sales Invoice No. 4640.

29

Sold 1 Wood Patio Door€”Single at $1,345.00 each, 1 Garage Fire Door at $425.00, and 12 Casement Slider€”Single windows at $395.00 each to Eric Reinhart, terms 30 days, 6% sales tax. Sales Invoice No. 4641.

Step 12: Enter the cash receipts transactions.

Cash Receipts Transactions

Mar. 03

Received cash on account from Schaefer Builders, covering Sales Invoice No. 4636 for $12,435.00; less 2% discount for windows merchandise, $142.20; less 2% discount for doors merchandise, $106.50.

10

Received cash on account from Bickell Construction, covering Sales Invoice No. 4637 for $17,989.00; less 2% discount for windows merchandise, $241.05; less 2% discount for doors merchandise, $118.73.

14

Received cash on account from Quality Contractors, covering Sales Invoice No. 4638 for $15,573.00; less 2% discount for windows merchandise, $184.56; less 2% discount for doors merchandise, $126.90.

18

Received cash on account from Phillip Gilbert, covering Sales Invoice No. 4639 for $5,109.20; no discount.

28

Received cash on account from Penkhus Remodeling, Inc. covering Sales Invoice No. 4640 for $19,124.00; less 2% discount for windows merchandise, $305.88; less 2% discount for doors merchandise, $76.60.

Step 13: Display the vendor and customer lists.

Step 14: Display the purchase order, purchase invoice, and sales invoice registers for the month of March.

Step 15: Display the Inventory Transactions report for the month of March.

Step 16: Display the Average Cost Inventory Valuation report.

Step 17: Display the General, Purchases, Cash Payments, Sales, and Cash Receipts Journal reports for the month of March.

Step 18: Display the trial balance.

End-of-Month Activities

After the monthly transactions have been processed, the adjusting entries must be entered into the general journal. The financial statements may then be displayed. Use the adjustment data for the month of March for Keller Windows & Doors and the Trial Balance report prepared in Step 18 as the basis for preparing the adjusting entries.

Merchandise inventories on March 31:

Windows.....................................................$233,950.00

Doors...........................................................$119,485.00

Insurance expired during March.................... $225.00

Inventories of supplies on March 31:

Office supplies............................................... $1,635.00

Store supplies................................................ $1,900.00

Depreciation for March:

Office equipment............................................. $315.10

Store equipment.............................................. $415.25

Uncollectible accounts expense increase..... $150.00

Salaries Payable:

Sales salaries.................................................. $3,992.00

Administrative salaries .................................... $579.00

Additional income tax owed......................... $3,500.00

Step 1: Enter the adjusting entries in the general journal. Enter a reference of Adj.Ent. in the Reference text box.

Step 2: Display the adjusting entries.

Step 3: Use Check on the toolbar to check your work.

Step 4: Display the gross profit statements.

Step 5: Display the income statement.

Step 6: Display the retained earnings statement.

Step 7: Display the balance sheet.

Step 8: Display the budget report.

Step 9: Generate a Least Profitable Items graph and an Actual vs. Budget graph.

Step 10: Click Save on the toolbar to save the data file.

Step 11: Calculate a loan amount using the Loan Planner.

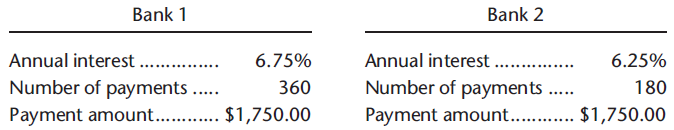

The management of Keller Windows & Doors believe they can comfortably afford a loan payment of $1,750.00 per month for the purchase of land and a building. They asked you to use the loan planner to find the loan amount, given the interest rate and number of payments information provided by two local banks.

Select the Loan Amount option in the Calculate grouping, and then enter the following loan information:

Step 12: Optional spreadsheet integration activity.

Prepare a monthly consolidated gross profit statement spreadsheet template file for Keller Windows & Doors.

a. Copy the gross profit statement (all three statements will be copied) to the clipboard in spreadsheet format.

b. Start your spreadsheet software and load the spreadsheet template file IA8 Spreadsheet 10-S. If you completed the spreadsheet activity in Sample Problem 10-S, load your completed spreadsheet file instead.

c. Select cell A1 as the current cell (if not already selected) and paste the gross profit statements copied to the clipboard in step a. into the spreadsheet. If you loaded the spreadsheet template file you completed in Sample Problem 10-S, skip to step h.

d. Enter the appropriate cell references for Department 1 (Windows) into their corresponding cells in B110€“B128.

e. Enter the appropriate cell references for Department 2 (Doors) into their corresponding cells in C110€“C128.

f. In cell D110, enter the formula appropriate for your spreadsheet software to sum the two departments. Copy the formula to the appropriate cells in D111€“D128.

g. In cell E110, enter the formula appropriate for your spreadsheet software to calculate the component percentage of total operating revenue. Copy the formula to the appropriate cells in E111€“E128. h. Print the completed monthly consolidated gross profit statement. Use the spreadsheet report shown in Figure 10.24 as a guide.

i. Save the template file with a file name of 10-A Your Name.

Step 13: Optional word processing integration activity.

Use your word processor to enhance the appearance of the monthly spreadsheet consolidated gross profit statement for distribution to the management of Keller Windows & Doors.

a. Copy the completed gross profit statement from the spreadsheet (cells A101€“E129) to the clipboard.

b. Start your word processing application software, create a new document, and then paste the report.

c. Format the report to enhance its appearance. Use the example shown in Figure 10.25 as a guide.

d. Save the document to your disk or folder with a file name of 10-A Your Name.

e. End your spreadsheet and word processing sessions.

Step 14: End the Integrated Accounting 8e session.

Financial StatementsFinancial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial... Distribution

The word "distribution" has several meanings in the financial world, most of them pertaining to the payment of assets from a fund, account, or individual security to an investor or beneficiary. Retirement account distributions are among the most...

Step by Step Answer:

Integrated Accounting

ISBN: 978-1285462721

8th edition

Authors: Dale A. Klooster, Warren Allen, Glenn Owen