Fossil Field is jointly owned by Allen Company (70% WI) who acts as field operator, and Garza

Question:

Fossil Field is jointly owned by Allen Company (70% WI) who acts as field operator, and Garza Company (30% WI). There is a 1/6 royalty. The 1/6 royalty is shared proportionally by Allen and Garza. The two working interest owners have agreed that Allen’s purchaser will take gas produced in July and Garza’s purchaser will take gas produced in August. Gas allocations will be equalized in September. Assume each working interest owner receives payment only for gas delivered to his purchaser(s). Ignore severance taxes.

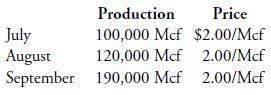

Production and gas prices were as follows:

REQUIRED:

a. Prepare the Gas Balance Report for Allen Company to summarize the production deliveries and equalization of gas for July through September.

b. Prepare the journal entries for each company during the three-month period assuming that both companies use the sales method for both revenue and royalty.

c. Prepare the journal entries for each company during the three-month period assuming that both companies use the entitlement method for both revenue and royalty.

Step by Step Answer:

Fundamentals Of Oil And Gas Accounting

ISBN: 9780878147939

4th Edition

Authors: Rebecca A. Gallun, Ph.D. Wright, Charlotte J, Linda M. Nichols, John W. Stevenson