Hard Times Oil Company, an integrated producer, has an unproved property with acquisition and capitalized G&G costs

Question:

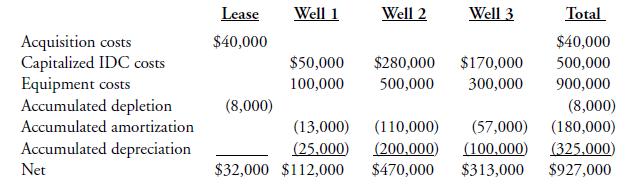

Hard Times Oil Company, an integrated producer, has an unproved property with acquisition and capitalized G&G costs of \($35,000.\) Hard Times also has a proved property with the following costs:

Determine the amount of the tax loss in each of the following situations:

a. Hard Times drilled a dry hole on the unproved property costing \($250,000\) for IDC and \($60,000\) for equipment. Equipment worth \($10,000\) was salvaged.

b. As a result of the dry hole, Hard Times decided to abandon the unproved property.

c. Hard Times abandoned Well 1 on the proved property. Wells 2 and 3 are still producing.

Assume that the wells had been depreciated separately.

d. Assume that instead of c, Hard Times abandoned the entire lease and that equipment worth \($27,000\) was salvaged.

Step by Step Answer:

Fundamentals Of Oil And Gas Accounting

ISBN: 9780878147939

4th Edition

Authors: Rebecca A. Gallun, Ph.D. Wright, Charlotte J, Linda M. Nichols, John W. Stevenson