Accounting, Analysis, and Principles Savannah, Inc. is a manufacturing company that manufactures and sells a single product.

Question:

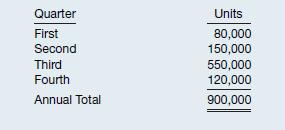

Accounting, Analysis, and Principles Savannah, Inc. is a manufacturing company that manufactures and sells a single product. Unit sales for each of the four quarters of 2015 are projected as follows.

Savannah incurs variable manufacturing costs of £0.40 per unit and variable non-manufacturing costs of £0.35 per unit. Savannah will incur fixed manufacturing costs of £720,000 and fixed non-manufacturing costs of £1,080,000. Savannah will sell its product for £4.00 per unit.

Accounting Determine the amount of net income Savannah will report in each of the four quarters of 2015, assuming actual sales are as projected and employing

(a) the integral approach to interim financial reporting and (b)

the discrete approach to interim financial reporting. Ignore income taxes.

Analysis Compute Savannah’s profit margin on sales for each of the four quarters of 2015. What effect does employing the integral approach instead of the discrete approach have on the degree to which Savannah’s profit margin on sales varies from quarter to quarter?

Principles Should Savannah implement the integral or discrete approach under IFRS? Do you agree? That is, explain the conceptual rationale behind the integral approach to interim financial reporting.

Step by Step Answer:

Intermediate Accounting IFRS Edition

ISBN: 9781118443965

2nd Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield