(Long-Term Contract with an Overall Loss) On July 1, 2007, Kyung-wook Construction Com- 4,5) pany Inc. contracted...

Question:

(Long-Term Contract with an Overall Loss) On July 1, 2007, Kyung-wook Construction Com-

4,5) pany Inc. contracted to build an office building for Mingxia Corp. for a total contract price of $1,950,000.

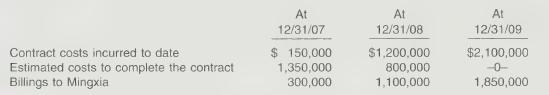

On July 1, Kyung-wook estimated that it would take between 2 and 3 years to complete the building. On December 31, 2009, the building was deemed substantially completed. Following are accumulated contract costs incurred, estimated costs to complete the contract, and accumulated billings to Mingxia for 2007, 2008, and 2009.

Instructions

(a) Using the percentage-of-completion method, prepare schedules to compute the profit or loss to be recognized as a result of this contract for the years ended December 31, 2007, 2008, and 2009.

(Ignore income taxes.)

(b) Using the completed-contract method, prepare schedules to compute the profit or loss to be recognized as a result of this contract for the years ended December 2007, 2008, and 2069. (Ignore income taxes.)

Step by Step Answer:

Intermediate Accounting 2007 FASB Update Volume 2

ISBN: 9780470128763

12th Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield