The pre-tax income of Barrows Ltd. for the first three years was as follows: The company had

Question:

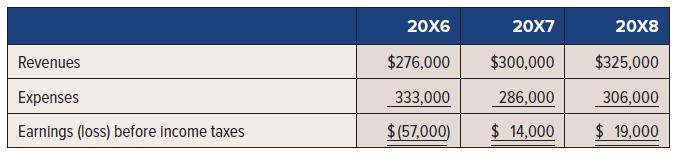

The pre-tax income of Barrows Ltd. for the first three years was as follows:

The company had no temporary differences in any of the three years. The income tax rate was constant at 36%.

In 20X6 and 20X7, the prospect for future earnings was highly uncertain. In 20X8, management decided that the future outlook for the company was quite good and that significant earnings would be generated in the near future.

Required:

1. Restate the above statements of comprehensive income to reflect income tax effects for each year.

2. Show any amounts relating to income taxes that would be reported on Barrows’ statement of financial position in each of the three years.

3. Prepare journal entries to record income taxes in each year. The company’s accountant has recommended using the valuation allowance approach to recording tax loss carryforward benefits.

Step by Step Answer:

Intermediate Accounting Volume 2

ISBN: 9781260881240

8th Edition

Authors: Thomas H. Beechy, Joan E. Conrod, Elizabeth Farrell, Ingrid McLeod-Dick, Kayla Tomulka, Romi-Lee Sevel