3. Incremental Cost Analysis A countys recycling program collected 46,280 tons of recyclable refuse this year. The

Question:

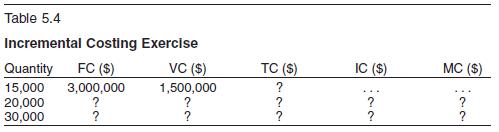

3. Incremental Cost Analysis A county’s recycling program collected 46,280 tons of recyclable refuse this year. The cost of the program includes five vehicles that can partly process the recycles. The county does not have depreciation information for these trucks. But they estimate annual maintenance costs of up to $10,000 for each truck. The fuel expense totaled $69,000 this year. The county also hires fifty workers in the program. The annual personnel expense this year was $1.5 million. Other expenses this year included office expenses of $15,000, overhead of $189,000, and miscellaneous expenses of $150,000.

Recently, a small nearby city asked the county to provide recycling services.

The city offered a fixed fee of $6.00 for every ton of recyclable material pickup. It is estimated that there will be 3,500 tons of pickup during

the next year from the city.

County analysts studied the proposal. They reckoned that, to add 3,500 tons of pickup, the county did not need new vehicles or new hiring. Office and miscellaneous expenses would also remain the same. But, the fuel consumption and the overhead would increase.

Treating fuel and overhead as variable costs and others as fixed costs, calculate the incremental cost and marginal cost for the county. Should the county accept the city’s offer? Discuss in detail the logic of your decision.

Explain explicitly any assumption you make.

Step by Step Answer:

Financial Management In The Public Sector Tools Applications And Cases

ISBN: 9780765616784

1st Edition

Authors: Xiaohu Wang