The following information is given for Helaminge Ltd at 30 September 20*8: Authorised and issued share capital

Question:

The following information is given for Helaminge Ltd at 30 September 20*8:

Authorised and issued share capital 800,000 ordinary shares of 25 pence each; premises at cost £80,000; machinery at cost £60,000; vehicle at cost £30,000; inventories £20,000; trade receivables £12,000; bank £6,000; trade payables £8,000.

Required

Prepare a balance sheet at 30 September 20*8.

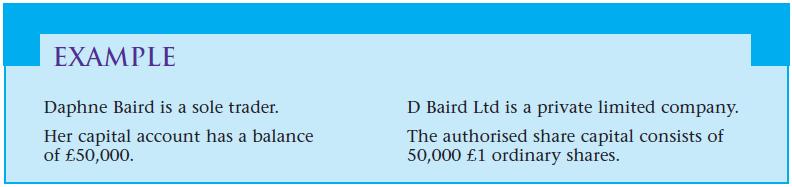

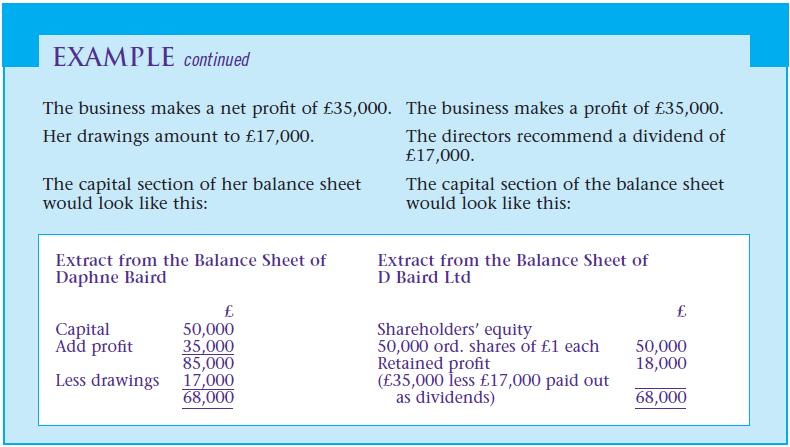

The profit generated by the business of a sole trader belongs to the trader. It is credited to his capital account.

The profits that are removed from the business as drawings are deducted from the capital.

The remainder of the profit is ‘ploughed back’ and may be used to purchase assets.

The same is true of a limited company. Some profits will leave the business as dividends. The remainder is ‘ploughed back’ and may be used to purchase assets.

Consider this example:

Step by Step Answer: