The following capital gains and losses have been computed using the $1,000 rule: REQUIRED Compute net taxable

Question:

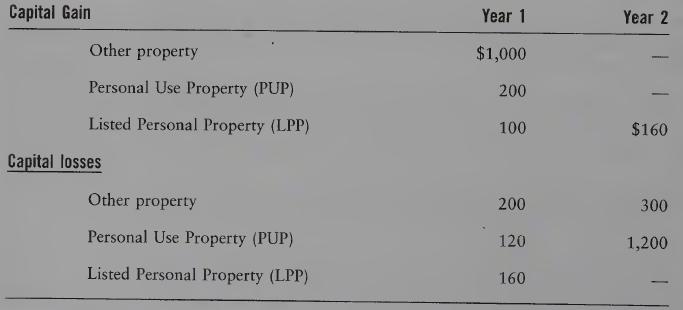

The following capital gains and losses have been computed using the $1,000 rule:

REQUIRED

Compute net taxable capital gains for taxations years 1 and 2

Transcribed Image Text:

Capital Gain Other property Personal Use Property (PUP) Listed Personal Property (LPP) Capital losses Other property Personal Use Property (PUP) Listed Personal Property (LPP) Year 1 $1,000 200 100 200 120 160 Year 2 $160 300 1,200

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 83% (6 reviews)

NOTES TO SOLUTION 1 Taxable net gains from LPP ...View the full answer

Answered By

Ashington Waweru

I am a lecturer, research writer and also a qualified financial analyst and accountant. I am qualified and articulate in many disciplines including English, Accounting, Finance, Quantitative spreadsheet analysis, Economics, and Statistics. I am an expert with sixteen years of experience in online industry-related work. I have a master's in business administration and a bachelor’s degree in education, accounting, and economics options.

I am a writer and proofreading expert with sixteen years of experience in online writing, proofreading, and text editing. I have vast knowledge and experience in writing techniques and styles such as APA, ASA, MLA, Chicago, Turabian, IEEE, and many others.

I am also an online blogger and research writer with sixteen years of writing and proofreading articles and reports. I have written many scripts and articles for blogs, and I also specialize in search engine

I have sixteen years of experience in Excel data entry, Excel data analysis, R-studio quantitative analysis, SPSS quantitative analysis, research writing, and proofreading articles and reports. I will deliver the highest quality online and offline Excel, R, SPSS, and other spreadsheet solutions within your operational deadlines. I have also compiled many original Excel quantitative and text spreadsheets which solve client’s problems in my research writing career.

I have extensive enterprise resource planning accounting, financial modeling, financial reporting, and company analysis: customer relationship management, enterprise resource planning, financial accounting projects, and corporate finance.

I am articulate in psychology, engineering, nursing, counseling, project management, accounting, finance, quantitative spreadsheet analysis, statistical and economic analysis, among many other industry fields and academic disciplines. I work to solve problems and provide accurate and credible solutions and research reports in all industries in the global economy.

I have taught and conducted masters and Ph.D. thesis research for specialists in Quantitative finance, Financial Accounting, Actuarial science, Macroeconomics, Microeconomics, Risk Management, Managerial Economics, Engineering Economics, Financial economics, Taxation and many other disciplines including water engineering, psychology, e-commerce, mechanical engineering, leadership and many others.

I have developed many courses on online websites like Teachable and Thinkific. I also developed an accounting reporting automation software project for Utafiti sacco located at ILRI Uthiru Kenya when I was working there in year 2001.

I am a mature, self-motivated worker who delivers high-quality, on-time reports which solve client’s problems accurately.

I have written many academic and professional industry research papers and tutored many clients from college to university undergraduate, master's and Ph.D. students, and corporate professionals. I anticipate your hiring me.

I know I will deliver the highest quality work you will find anywhere to award me your project work. Please note that I am looking for a long-term work relationship with you. I look forward to you delivering the best service to you.

3.00+

2+ Reviews

10+ Question Solved

Related Book For

Introduction To Federal Income Taxation In Canada 2016-2017

ISBN: 9781554968725

37th Edition

Authors: Robert E. Beam, Stanley N. Laiken, James J. Barnett

Question Posted:

Students also viewed these Business questions

-

Compute the pseudo inverse of A. 2 -1 1 -2 2

-

In Problems 24 and 25, find the intercepts and graph each line. 1 2 + 1 3 2

-

The following additional information is available for the Dr. Ivan and Irene Incisor family from Chapters 1-6. On December 12, Irene purchased the building where her store is located. She paid...

-

Bank Teller Staffing Plan As the teller supervisor at Montana Federal Credit Union you are responsible for developing a staffing plan for tellers that meets customer needs, satisfies the union...

-

Avery, Hodge, and Associates provides legal services for its local community. In addition to its regular attorneys, the firm hires some part-time attorneys to handle small cases. Two secretaries...

-

What are the four main methods for determining a companys promotional budget?

-

Digital storefronts such as Etsy allow small producers to have a presence in the online marketplace. What benefits do these online storefronts offer small producers? What benefits do they offer...

-

A firm is considering the following investment project: The project has a 5-year useful life with a $125,000 salvage value, as shown. Double declining balance depreciation will be used, assuming the...

-

Year 0: (54,000) Year 1: 21,000 Year 2: 14,000 Year 3: 23,400 What is the net present value of this stream of cash flows if the discount rate is 9%? $8421 $3128 $107 ($2415) ($4881)

-

Spouse A owns two residences: Both spouses have resided in both homes since 2004. In 2011, Spouse A transferred Residence 2 to Spouse B as a gift. Spouse B sold the transferred residence in 2016 for...

-

A pyramid has height 10 feet and a square base with side length 7 feet. a. How does the volume of the pyramid change if the base stays the same and the height is doubled? b. How does the volume of...

-

Under what conditions would Apple opt to use a defensive strategic market plan?

-

2. (10 points) Two suppliers of products are available to supply the needs of four supermarkets. Each supplier can provide 90 units per day. Each supermarket would like to receive 60 units per day....

-

QUESTION 3 (11 marks) Midrand Ltd acquired a 90% interest in Bramely Ltd on 2 December 20.21 for R2 million. The consideration was settled as follows: Cash payment, Issue of 100 000 shares to the...

-

1. Prepare a Proforma Income Statement for ACCO 295 Corp. (30 points) Use the same Excel table provided to do the calculations with the class explanation. 1. Selling and administrative expenses were...

-

Sandy Foot Hospital expanded their cardiovascular unit to include more operating rooms. They negotiated a 20-year loan with monthly payments and a large sum of $250,000 due at the end of the loan....

-

Oscillations and Resonance Name Lab Procedure Answer questions in red. Download and run the HTMLS application \"resonance\". Driving force: 30 N Driving equency: 5 rad. '5 Spring constant: 5 - 'Irn...

-

Explain how Cole Hardware used technology to manage inventory and identify at least two (2) benefits of the use of this technology by the company. https://youtu.be/1d0O8MAMyAM Watch BNET Video's...

-

7. Baladna wants to analyze process that includes delivery by suppliers, production inside the company, transportation to to its customers and information systems. Then it also wants to find out...

-

The taxpayer, whose head office was in Manitoba, manufactured and sold various fans. Local sales agencies were maintained in Ontario and in Quebec. At the Ontario agency, two qualified...

-

Barltrop Limited is a Canadian public company involved in the software consulting business. Its controller provided you with the following information related to its 2012 taxation year ended December...

-

Infotech is a public company in its first year of business in the information technology industry. It operates out of a plant in Ottawa, Ontario. In 2012, it incurred $2.2 million of scientific...

-

Minden Company introduced a new product last year for which it is trying to find an optimal selling price. Marketing studies suggest that the company can increase sales by 5,000 units for each $2...

-

Prepare the adjusting journal entries and Post the adjusting journal entries to the T-accounts and adjust the trial balance. Dresser paid the interest due on the Bonds Payable on January 1. Dresser...

-

Venneman Company produces a product that requires 7 standard pounds per unit. The standard price is $11.50 per pound. If 3,900 units required 28,400 pounds, which were purchased at $10.92 per pound,...

Study smarter with the SolutionInn App