You have just been given the tangible non-current assets section from the audit file of Weller Limited

Question:

You have just been given the tangible non-current assets section from the audit file of Weller Limited ("Weller") in relation to the financial statements for the year ended 31 December 2017, with a note from the partner-in-charge asking you to clear the outstanding review points.

Review point 1:

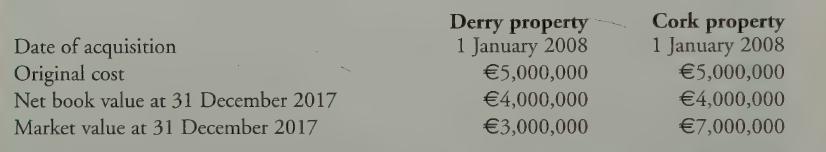

Weller owns two freehold properties, one in Derry and the other in Cork. The company uses both as regional administrative offices. The properties had an expected useful life of 50 years on their date of acquisition, and the directors believe that this assumption is still appropriate at 31 December 2017. It is company policy to depreciate the properties on a straight-line basis over their estimated useful economic life.

In the financial statements for the year ended 31 December 2017, the directors of Weller are proposing to show the Cork property at market value and the Derry property at its depreciated historic cost. The directors believe the fall in the market value of the Derry property is only temporary and property values in the Derry area will rise in the next one to two years. Is the policy put forward by the directors of Weller acceptable?

Review point 2:

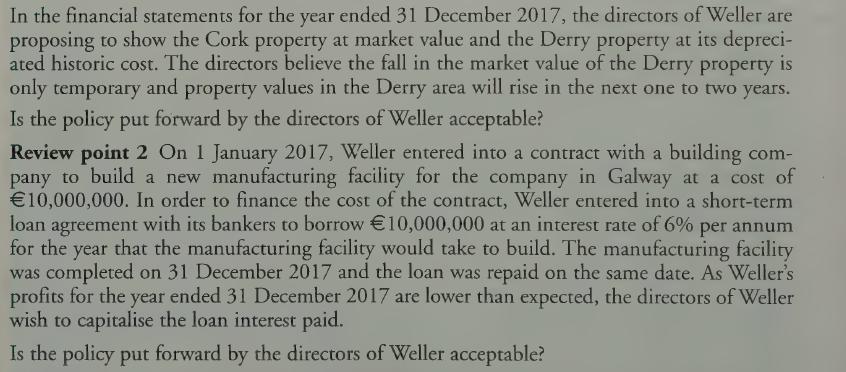

On 1 January 2017, Weller entered into a contract with a building company to build a new manufacturing facility for the company in Galway at a cost of 10,000,000. In order to finance the cost of the contract, Weller entered into a short-term loan agreement with its bankers to borrow 10,000,000 at an interest rate of 6% per annum for the year that the manufacturing facility would take to build. The manufacturing facility was completed on 31 December 2017 and the loan was repaid on the same date. As Weller's profits for the year ended 31 December 2017 are lower than expected, the directors of Weller wish to capitalize the loan interest paid. Is the policy put forward by the directors of Weller acceptable?

Review point 3:

Review point 3:

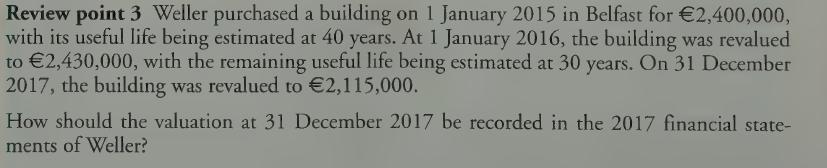

Weller purchased a building on 1 January 2015 in Belfast for 2,400,000, with its useful life being estimated at 40 years. At 1 January 2016, the building was revalued to 2,430,000, with the remaining useful life being estimated at 30 years. On 31 December 2017, the building was revalued to 2,115,000. How should the valuation at 31 December 2017 be recorded in the 2017 financial statements of Weller?

Review point 4:

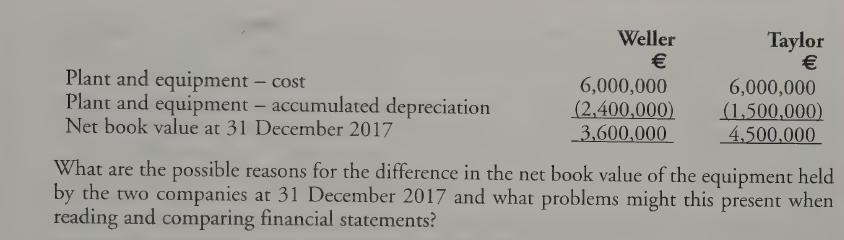

Taylor Limited ("Taylor") is also an audit client of your firm. The company operates in the same business as Weller and is similar in size. Both companies purchased identical equipment from the same supplier on 1 January 2016 at a cost of 6,000,000. Shown below are extracts from the tangible non-current assets notes of both companies in respect of this equipment.

Review point 5:

In 2005, Weller purchased freehold land that it carries in its financial statements at its original cost of 1,000,000 without charging depreciation. Are there valid reasons for the policy of non-depreciation of freehold land?

Requirement:

Prepare a memorandum addressed to the partner-in-charge of the audit of Weller addressing the issues raised in each of the review points.

Step by Step Answer:

International Financial Accounting And Reporting

ISBN: 9781912350025

6th Edition

Authors: Ciaran Connolly