Mortgage lenders are interested in determining borrower and loan characteristics that may lead to delinquency or foreclosure.

Question:

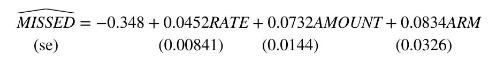

Mortgage lenders are interested in determining borrower and loan characteristics that may lead to delinquency or foreclosure. We estimate a regression model using 1000 observations and the following variables. The dependent variable of interest is MISSED, an indicator variable \(=1\) if the borrower missed at least three payments (90+ days late), but 0 otherwise. Explanatory variables are \(R A T E=\) initial interest rate of the mortgage; \(A M O U N T=\) dollar value of mortgage (in \(\$ 100,000\) ); and \(A R M=1\) if mortgage has an adjustable rate, and \(=0\) if mortgage has a fixed rate. The estimated equation is

a. Interpret the signs and significance of each of the coefficients.

b. Two borrowers who did not miss a payment had loans with the following characteristics: \((R A T E=8.2, A M O U N T=1.912, A R M=1)\) and \((R A T E=9.1, A M O U N T=8.6665, A R M=1)\). For each of these borrowers, predict the probability that they will miss a payment.

c. Two borrowers who did miss a payment had loans with the following characteristics: \((R A T E=12.0\), AMOUNT \(=0.71, A R M=0)\) and \((R A T E=6.45\), AMOUNT \(=8.5, A R M=1)\). For each of these borrowers, predict the probability that they will miss a payment.

d. For a borrower seeking an adjustable rate mortgage, with an initial interest rate of 6.0, above what loan amount would you predict a missed payment with probability 0.51?

Step by Step Answer:

Principles Of Econometrics

ISBN: 9781118452271

5th Edition

Authors: R Carter Hill, William E Griffiths, Guay C Lim