2. One of the most important questions in financial economics is what factors determine the cross-sectional variation

Question:

2. One of the most important questions in financial economics is what factors determine the cross-sectional variation in an asset’s returns. Some have argued that book-to-market ratio and size (market value of equity) play an important role.

A. Write a multiple regression equation to test whether book-to-market ratio and size explain the cross-section of asset returns. Use the notations below.

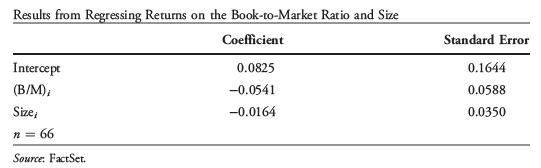

(B/M)i ¼ book-to-market ratio for asset i Ri ¼ return on asset i in a particular month Sizei ¼ natural log of the market value of equity for asset i B. The table below shows the results of the linear regression for a cross-section of 66 companies. The size and book-to-market data for each company are for December 2001. The return data for each company are for January 2002.

Determine whether the book-to-market ratio and size are each useful for explaining the cross-section of asset returns. Use a 0.05 significance level to make your decision.

Step by Step Answer: