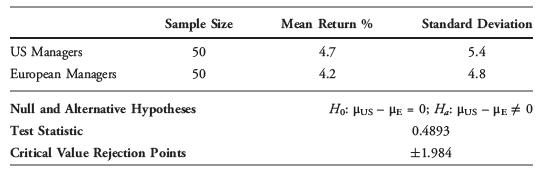

34. An investment consultant conducts two independent random samples of 5-year performance data for US and European

Question:

34. An investment consultant conducts two independent random samples of 5-year performance data for US and European absolute return hedge funds. Noting a 50-basis point-return advantage for US managers, the consultant decides to test whether the two means are statistically different from one another at a 0.05 level of significance. The two populations are assumed to be normally distributed with unknown but equal variances.

Results of the hypothesis test are contained in the tables below.

μUS is the mean return for US funds and μE is the mean return for European funds.

The results of the hypothesis test indicate that the:

A. null hypothesis is not rejected.

B. alternative hypothesis is statistically confirmed.

C. difference in mean returns is statistically different from zero.

Step by Step Answer: