5. The neglected-company effect claims that companies that are followed by fewer analysts will earn higher returns

Question:

5. The neglected-company effect claims that companies that are followed by fewer analysts will earn higher returns on average than companies that are followed by many analysts.

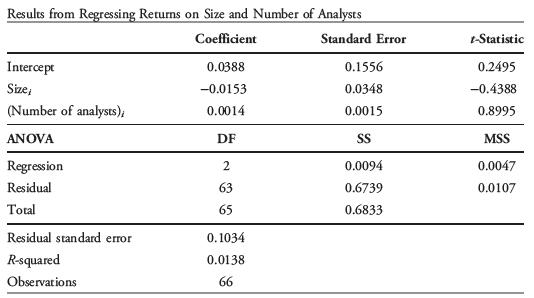

To test the neglected-company effect, you have collected data on 66 companies and the number of analysts providing earnings estimates for each company. You decide to also include size as an independent variable, measuring size as the log of the market value of the company’s equity, to try to distinguish any small-company effect from a neglectedcompany effect. The small-company effect asserts that small-company stocks may earn average higher risk-adjusted returns than large-company stocks.

The table below shows the results from estimating the model Ri ¼ b0 þ b1Sizei þ b2(Number of analysts)i þ εi for a cross-section of 66 companies. The size and number of analysts for each company are for December 2001. The return data are for January 2002.

A. What test would you conduct to see whether the two independent variables are jointly statistically related to returns (H0: b1 ¼ b2 ¼ 0)?

B. What information do you need to conduct the appropriate test?

C. Determine whether the two variables jointly are statistically related to returns at the 0.05 significance level.

D. Explain the meaning of adjusted R2 and state whether adjusted R2 for the regression would be smaller than, equal to, or larger than 0.0138.

Step by Step Answer: