As seen in the following table, the 2008 financial crisis left the United States with an enormous

Question:

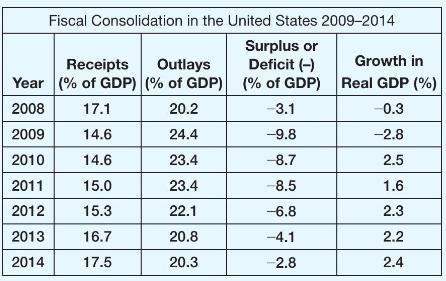

As seen in the following table, the 2008 financial crisis left the United States with an enormous federal budget deficit in 2009 .

There was a substantial fiscal consolidation from 2011 onward, yet real output continued to grow.

a. Which played a larger role in the fiscal consolidation: raising taxes, or reducing outlays?

b. In terms of the language of the text, if this fiscal consolidation were anticipated as of 2009 , was it "backloaded?" How might this help minimize the effects of the fiscal consolidation on output growth?

c. We know from Question 2 that monetary policy maintained the nominal policy rate of interest of close to \(0 \%\) throughout this period and promised to maintain low interest rates into the future. Why did it do so?

d. The Federal Reserve introduced a target rate of inflation during the consolidation period on January 25, 2012. What is one advantage of introducing a policy where inflation is targeted at \(2 \%\) during a period of zero interest rates and fiscal consolidation?

e. We used the University of Michigan's Index of Consumer Sentiment in the previous chapter as a measure of expectations of households about the future. You can look at the values of this index at the FRED database maintained by the Federal Reserve Bank of St. Louis (series UMCSENT). Find this index and comment on its evolution from 2010 to 2014 as the fiscal consolidation proceeded.

Data from Question 2

Consider these quotes concerning Federal Reserve policy.

a. On January 25, 2012 the Federal Reserve made two announcements. Here are excerpts from each:

The announcement about the path of short-term interest rates:

To support a stronger economic recovery and to help ensure that inflation, over time, is at levels consistent with the dual mandate, the Committee expects to maintain a highly accommodative stance for monetary policy. In particular, the Committee decided today to keep the target range for the federal funds rate at 0 to \(1 / 4 \%\) and currently anticipates that economic conditions-including low rates of resource utilization and a subdued outlook for inflation over the medium runare likely to warrant exceptionally low levels for the federal funds rate at least through late 2014.

The formal announcement of an inflation target:

The inflation rate over the longer run is primarily determined by monetary policy, and hence the Committee has the ability to specify a longer-run goal for inflation. The Committee judges that inflation at the rate of \(2 \%\), as measured by the annual change in the price index for personal consumption expenditures, is most consistent over the longer run with the Federal Reserve's statutory mandate. Communicating this inflation goal clearly to the public helps keep longer-term inflation expectations firmly anchored, thereby fostering price stability and moderate long-term interest rates and enhancing the Committee's ability to promote maximum employment in the face of significant economic disturbances.

What do you think was the combined goal of the two announcements? What do they imply about real interest rates?

b. The monetary policy announcement December 19, 2018:

Information received since the Federal Open Market Committee met in November indicates that the labor market has continued to strengthen and that economic activity has been rising at a strong rate. Job gains have been strong, on average, in recent months, and the unemployment rate has remained low. Household spending has continued to grow strongly, while growth of business fixed investment has moderated from its rapid pace earlier in the year. On a 12-month basis, both overall inflation and inflation for items other than food and energy remain near \(2 \%\). Indicators of longerterm inflation expectations are little changed, on balance.

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. The Committee judges that some further gradual increases in the target range for the federal funds rate will be consistent with sustained expansion of economic activity, strong labor market conditions, and inflation near the Committee's symmetric \(2 \%\) objective over the medium term.

In view of realized and expected labor market conditions and inflation, the Committee decided to raise the target range for the federal funds rate to \(2-1 / 4\) to \(2-1 / 2 \%\).

What happened to the target range for the policy interest rate in this announcement? What information was given about the future course of policy interest rates? How was the decision justified? Can you make an inference about the value of the neutral policy rate of interest from this announcement?

Step by Step Answer: