Relevant costs and revenues; marketing channels Diamond Bicycle Com pany manufactures and sells bicycles nationwide through marketing

Question:

Relevant costs and revenues; marketing channels Diamond Bicycle Com¬

pany manufactures and sells bicycles nationwide through marketing channels ranging from sporting goods stores to specialty bicycle shops. Diamond's av¬ erage selling price to its distributors is $185 per bicycle. The bicycles are re¬ tailed to customers for $349.

After several years of high sales, Diamond's sales have slumped to 160,000 bicycles per year in the last three years, which is only 70% of its manufacturing capacity. Diamond expects the demand for its products to re¬ main the same in the next few years.

Premier Stores, a nationwide chain of discount retail stores, has recently approached Diamond to manufacture bicycles for Premier to sell Premier has offered to purchase 40,000 bicycles annually for a three-year period at $125 per bicycle. It is not willing to pay a higher price because it plans to retail the bicycles at only $200. Diamond has not previously sold bicycles through any marketing channel other than specialty stores.

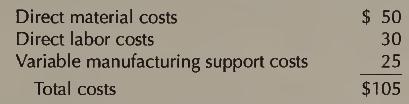

Mike Diamond is the chief executive officer of Diamond Bicycle. Al¬ though Premier's offer is well below Diamond's normal price, Mike is inter¬ ested in the offer because Diamond has considerable surplus capacity. He has been supplied with the following variable product cost information:

The direct materials cost includes $2 for embossing Premier's private label on the bicycle.

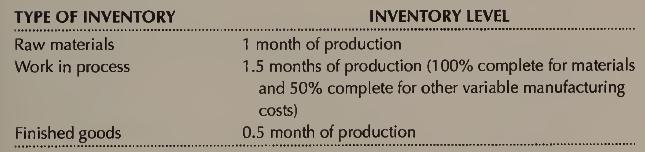

Fixed support costs total $2,000,000 annually. Diamond also pays its sales staff a 10% commission but will not need to pay any salesperson for the special sale to Premier. Average inventory levels for Premier's offer are esti¬ mated to be as follows:

Annual inventory carrying cost is estimated to be 10% of the inventory carrying value. Premier's offer requires Diamond to deliver bicycles to Pre¬ mier's regional warehouse so that Premier can have ready access to an inven¬ tory of bicycles to meet fluctuating market demand. Diamond estimated that about 5% of Diamond's present sales will be lost if Premier's offer is accepted because some customers will comparison shop and find the same quality bi¬ cycle available at a lower price in Premier stores.

REQUIRED

(a) Should Mike Diamond accept Premier's offer?

(b) What strategic and other factors should be considered before Mike makes a final decision?

Step by Step Answer:

Management Accounting

ISBN: 9780130101952

3rd Edition

Authors: Anthony A. Atkinson, Robert S. Kaplan, S. Mark Young, Rajiv D. Banker, Pajiv D. Banker