Advanced: Calculation of EOQ, discussion of the limitations of EOQ and a discussion of JIT The newly-appointed

Question:

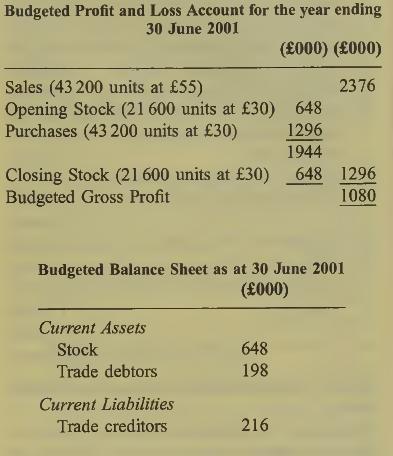

Advanced: Calculation of EOQ, discussion of the limitations of EOQ and a discussion of JIT The newly-appointed managing director of a divi¬ sion of Bondini pic is concerned about the length of the division’s cash operating cycle. Extracts from the latest budget are given below:

The following information has also been gathered for the managing director:

(1) Sales were made evenly during the twelve months to 30 June 2000.

(2) The amount for trade creditors relates only to purchases of stock.

(3) The division is charged interest at the rate of 15% per annum on the average level of net assets held in a year.

(4) The company rents sufficient space in a ware¬ house to store the necessary stock at an annual cost of £3.25 per unit.

(5) The costs of ordering items of stock are as follows:

Insurance cost per order £900 Transport cost per order £750 (6) There will be no change in debtor and creditor payment periods.

In addition, the division maintains a purchasing department at an annual budgeted cost of £72 000.

The managing director has heard about the economic order quantity (EOQ) model and would prefer this basis to be used to calculate the order quantity. He estimates that the buffer stock level should be equal to one month’s sales in order to prevent loss of revenue due to stock-outs.

Requirements:

(a) Calculate the EOQ for the division and, assuming that the division uses this as the basis for ordering goods from 1 July 2000, calculate the cash amounts which would be paid to trade creditors in each of the eight months to 28 February 2001. (12 marks)

(b) Determine the length of the cash operating cycle at 30 June 2000 and calculate the improvement that will have taken place by 30 June 2001. (4 marks)

(c) Discuss the practical limitations of using the EOQ approach to determining order quantities.

(5 marks)

(d) Describe the advantages and disadvantages of the Just-In-Time approach (i.e. when minimal stocks are maintained and suppliers deliver as required). (4 marks)

(Total 25 marks)

ICAEW P2 Financial Management

Step by Step Answer: