Advanced : Comparison of variable and absorption standard costing Chimera Ltd makes chimes, one of a variety

Question:

Advanced : Comparison of variable and absorption standard costing Chimera Ltd makes chimes, one of a variety of products. These products pass through several production processes.

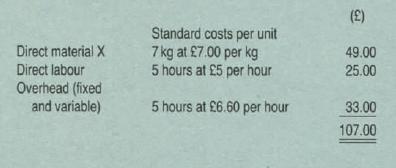

The first process is moulding and the standard costs for moulding chimes are as follows:

The overhead allocation rate is based on direct labour hours and comprises an allowance for both fixed and variable overhead costs.

With the aid of regression analysis the fixed element of overhead costs has been estimated at £9000 per week, and the variable element of overhead costs has been estimated at 60p per direct labour hour. The accounting records do not separate actual overhead costs between their fixed and variable elements.

The moulding department occupies its own premises, and all of the department's overhead costs can be regarded as being the responsibility of the departmental manager.

In week 27 the department moulded 294 chimes, and actual costs incurred were:

Direct material X (2030kg used) £14125 Direct labour (1520 hours worked) £7854 Overhead expenditure £10 200 The 1520 hours worked by direct labour included 40 hours overtime, which is paid at 50% above normal pay rates.

Requirements:

(a) Prepare a report for the moulding department manager on the results of the moulding department for week 27, presenting Information in a way which you consider to be most useful (9 marks)

(b) Discuss the treatment of overheads adopted in your report and describe an alternative treatment, contrasting its use with the method adopted 1n your report. (6 marks)

(c) Describe the approaches used for determining standards for direct costs and assess their main strengths and weakness.

Step by Step Answer: