Intermediate: Calculation of overhead variances Shown below is the previous month's overhead expenditure and activity, both budget

Question:

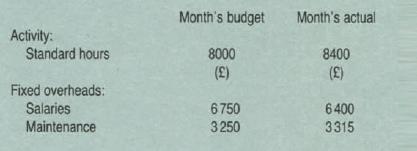

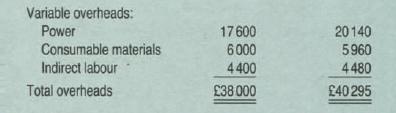

Intermediate: Calculation of overhead variances Shown below is the previous month's overhead expenditure and activity, both budget and actual, for one department in a manufacturing company.

The budgeted overheads shown above are based upon the anticipated activity of 8000 standard hours and it should be assumed that the department's budgeted overhead expenditure and activity occur evenly throughout the year. Variable overheads vary with standard hours produced.

The company operates a standard costing system and the department's total overheads are absorbed into production using a standard hour rate.

Required:

(a) Calculate the following variances incurred by the department during the previous month:

Fixed overhead volume variance Rxed overhead expenditure variance Variable overhead expenditure variance (9 marks)

(b) Draft a suitable operating statement which will assist management in controlling the department's overheads.

(9 marks)

(c) Carefully explain why the difference between budgeted and actual activity will cause a change in the anticipated profit by the amount of the volume variance calculated in

(a) above.

Step by Step Answer: