Intermediate: Contract costing Thomfield Ltd is a building contractor. During its financial year to 30 June 2000,

Question:

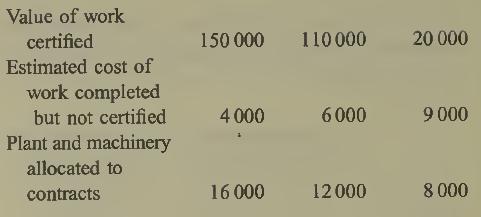

Intermediate: Contract costing Thomfield Ltd is a building contractor. During its financial year to 30 June 2000, it commenced three major contracts. Information relating to these contracts as at 30 June 2000 was as follows:

The plant and machinery allocated to the contracts was installed on the dates the contracts com¬ menced. The plant and machinery is expected to have a working life of four years in the case of contracts 1 and 3 and three years in the case of contract 2, and is to be depreciated on a straight line basis assuming nil residual values.

Since the last certificate ofwork was certified on contract number 1, faulty work has been discovered which is expected to cost £10000 to rectify. No rectification work has been commenced prior to 30 June 2000.

In addition to expending directly attributable to contracts, recoverable central overheads are esti¬ mated to amount to 2% of the cost of direct wages.

Thomfield Ltd has an accounting policy of taking two thirds of the profit attributable to the value of work certified on a contract, once the contract is one third completed. Anticipated losses on contracts are provided in full.

Progress claims equal to 80% of the value of work certified have been invoiced to customers.

You are required to:

(a) prepare contract accounts for each contract for the year to 30 June 2000, calculating any attributable profit or loss on each contract;

(12 marks)

(b) calculate the amount to be included in the balance sheet of Thomfield Ltd as on 30 June 2000 in respect of these contracts.

Step by Step Answer: