Intermediate: Integrated accounts. In the absence of the accountant you have been asked to prepare a months

Question:

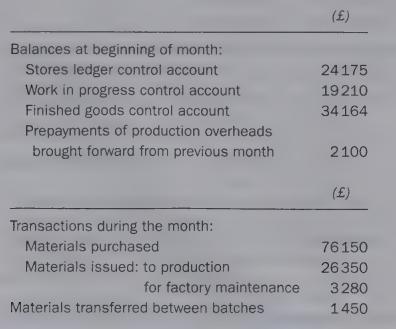

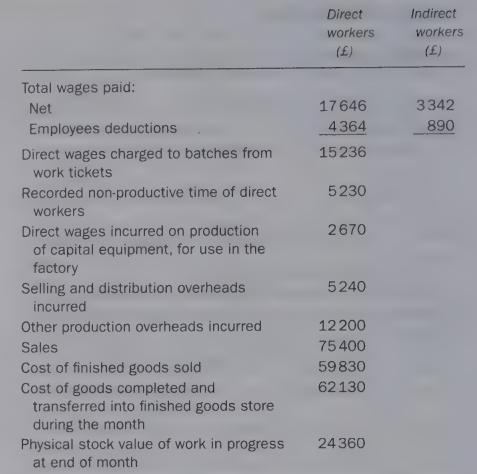

Intermediate: Integrated accounts. In the absence of the accountant you have been asked to prepare a month’s cost accounts for a company which operates a batch costing system fully integrated with the financial accounts. The cost clerk has provided you with the following information, which he thinks is relevant:

The production overhead absorption rate is 150 per cent of direct wages and it is the policy of the company to include a share of production overheads in the cost of capital equipment constructed in the factory.

Required:

(a) Prepare the following accounts for the month:

stores ledger control account wages control account work in progress control account finished goods control account production overhead control account profit/loss account. (12 marks)

(b) Identify any aspects of the accounts which you consider should be investigated. (4 marks)

(c) Explain why it is necessary to value a company’s stocks at the end of each period and also why, in a manufacturing company, expense items such as factory rent, wages of direct operatives, power costs, etc. are included in the value of work in progress and finished goods stocks.

(6 marks)

ACCA Level 1 Costing

Step by Step Answer: