Intermediate: Under- and over-absorption of overheads and calculation of budgeted expenditure and activity A large firm of

Question:

Intermediate: Under- and over-absorption of overheads and calculation of budgeted expenditure and activity A large firm of solicitors uses a job costing system to identify costs with individual clients. Hours worked by professional staff are used as the basis for charging overhead costs to client services. A predetermined rate is used, derived from budgets drawn up at the beginning of each year commen¬ cing on 1 April.

In the year to 31 March 2000 the overheads of the solicitors’ practice, which were absorbed at a rate of £7.50 per hour of professional staff, were over-absorbed by £4760. Actual overheads incurred were £742 600. Professional hours worked were 1360 over budget.

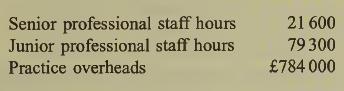

The solicitors’ practice has decided to refine its overhead charging system by differentiating between the hours of senior and junior professional staff, respectively. A premium of 40% is to be applied to the hourly overhead rate for senior staff compared with junior staff.

Budgets for the year to 31 March 2001 are as follows:

Required

(a) Calculate for the year ended 31 March 2000:

(i) budgeted professional staff hours;

(ii) budgeted overhead expenditure.

(b) Calculate, for the year ended 31 March 2001, the overhead absorption rates (to three deci¬ mal places of a £) to be applied to:

(i) senior professional staff hours;

(ii) junior professional staff hours.

(c) How is the change in method of charging overheads likely to improve the firm’s job costing system? (3 marks)

(d)Explain briefly why overhead absorbed using predetermined rates may differ from actual overhead incurred for the same period.

Step by Step Answer: