On August 5, 20X2, Jack Jackson, controller for Wixson Company, arrived at his office to find the

Question:

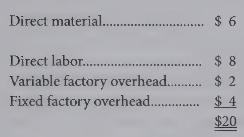

On August 5, 20X2, Jack Jackson, controller for Wixson Company, arrived at his office to find the company president in a rage. "These income statements you've prepared for June and July are ridiculous," the president said. "Sales and expenses for the two months were identical, yet you claim that we moved from a profit of \(\$ 15,000\) in June to a loss of \(\$ 1,000\) in July. Now I'm not an accountant, but I know better than to believe that. I expect a satisfactory explanation before you go home today." Somewhat sheepishly, Jack began to review the company's financial data for the previous two months. Sales of Wixson's single product each month had indeed been identical: 10,000 units in June and 10,000 units in July. The standard costs of the product were as follows:

The selling price was \(\$ 30\) per unit, and selling and administrative expenses (all fixed) were \(\$ 90,000\) each month. Normal activity was 10,000 units per month. Unfavorable materials, labor, and variable overhead variances totaled \(\$ 3,000\) in each month, and there were no fixed budget variances. Inventory levels were as follows: June \(1-1,000\) units; June \(30-3,000\) units; and July \(31-1,000\) units.

Required:

In order to aid Jack in this situation, complete the following:

(a) Compute the volume variance for June and for July.

(b) Present comparative income statements for the months of June and July using absorption costing.

(c) Explain why net income changed as it did over the two month period.

(d) Present comparative income statements using variable costing.

Step by Step Answer:

Cost Accounting For Managerial Planning Decision Making And Control

ISBN: 9781516551705

6th Edition

Authors: Woody Liao, Andrew Schiff, Stacy Kline