The managing partner of Hoofdorp Music Box Fabricators has become aware of the disadvantages of static budgets.

Question:

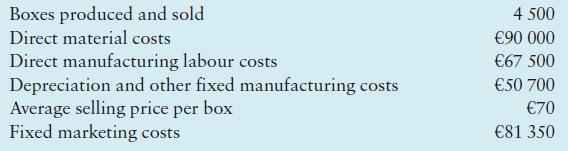

The managing partner of Hoofdorp Music Box Fabricators has become aware of the disadvantages of static budgets. She asks you to prepare a flexible budget for October 2022 for the main style of music box. The following partial data are available for the actual operations in August 2022 (a recent typical month):

Assume no opening or closing stocks of music boxes.

A 10% increase in the selling price is expected in October. The only variable marketing cost is a commission of €5.50 per unit paid to the manufacturers’ representatives, who bear all their own costs of travelling, entertaining customers, and so on. A patent royalty of €2 per box manufactured is paid to an independent design firm. Salary increases that will become effective in October are €12 000 per year for the production supervisor and €15 000 per year for the sales manager. A 10% increase in direct materials prices is expected to become effective in October. No changes are expected in direct manufacturing labour wage rates or in the productivity of the direct manufacturing labour personnel. Hoofdorp uses a normal costing system and does not have standard costs for any of its inputs.

Required

1 Prepare a flexible budget for October 2022, showing budgeted amounts at each of three output levels of music boxes: 4000, 5000 and 6000 units. (Use the flexible-budget approach of developing budgeted revenue and variable costs on a budgeted per output unit basis.)

2 Why might Hoofdorp Music Box Fabricators find a flexible budget more useful than a static budget? Explain.

Step by Step Answer:

Management And Cost Accounting

ISBN: 9781292436029

8th Edition

Authors: Alnoor Bhimani, Srikant Datar, Charles Horngren, Madhav Rajan