Isabelle Abiassi operates a popular summer camp for elementary school children. Projections for the current year are

Question:

Isabelle Abiassi operates a popular summer camp for elementary school children. Projections for the current year are as follows:

Sales revenue . . . . . . . . . . $8,000,000

Operating income . . . . . . . . . . $700,000

Average assets . . . . . . . . . . $4,000,000

The camp’s weighted-average cost of capital is 9%, and Isabelle requires that all new investments generate a return on investment of at least 12%. The camp’s current tax rate is 30%.

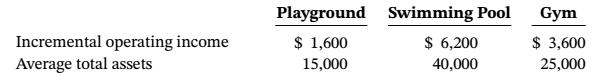

At last week’s advisory board meeting, Isabelle told the board that she had up to $70,000 to invest in new facilities at the camp and asked them to recommend some projects. Today the board’s president presented Isabelle with the following list of three potential investments to improve the camp facilities.

Required

a. Calculate the return on investment, residual income, and economic value added for each of the three projects.

b. Which of the three projects do you recommend Isabelle undertake? Why?

Step by Step Answer: