C. Berry Manufacturing Company produces two guitar models. One is a standard acoustic guitar that sells for

Question:

C. Berry Manufacturing Company produces two guitar models. One is a standard acoustic guitar that sells for \(\$ 600\) and is constructed from medium-grade materials. The other model is a custom-made amplified guitar with pearl inlays and a body constructed from special woods. The custom guitar sells for \(\$ 900\). Both guitars require 10 hours of direct labor to pro-duce, but the custom guitar is manufactured by more experienced workers who are paid at a higher rate.

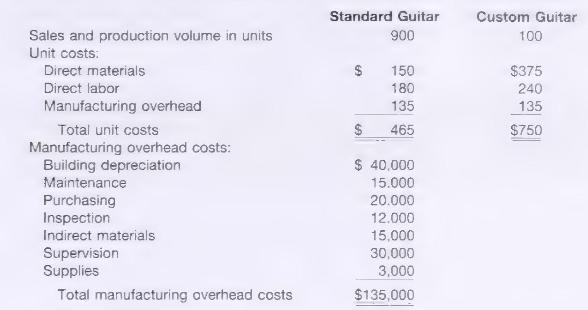

Most of C. Berry's sales come from the standard guitar, but sales of the custom model have been growing. Following is the company's sales, production, and cost information for last year:

The company allocates overhead costs using the traditional method. Its activity base is direct labor hours. The predetermined overhead rate, based on 10,000 direct labor hours, is \(\$ 13.50\) ( \(\$ 135,000 \div 10,000\) direct labor hours).

Nick Fessler, president of C. Berry, is concerned that the traditional cost-allocation system the company is using may not be generating accurate information and that the selling price of the custom guitar may not be covering its true cost.

\section*{Required}

A. The cost-allocation system C. Berry has been using allocates \(90 \%\) of overhead costs to the standard guitar because \(90 \%\) of direct labor hours were spent on the standard model. How much overhead was allocated to each of the two models last year? Discuss why this might not be an accurate way to assign overhead costs to products.

B. How would the use of more than one cost pool improve C. Berry's cost allocation?

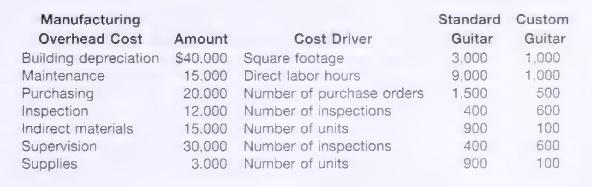

C. C. Berry's controller developed the following data:

Use activity-based costing to allocate the costs of overhead per unit and in total to each model of guitar.

D. Calculate the cost of a custom guitar using activity-based costing. Why is the cost different from the cost calculated using the traditional allocation method? At the current selling price, is the company covering its true cost of production? Explain your answer.

Step by Step Answer:

Managerial Accounting Information For Decisions

ISBN: 9780324222432

4th Edition

Authors: Thomas L. Albright , Robert W. Ingram, John S. Hill