The following comparative information is available for Rose Company for 2025. Instructions a. Determine net income under

Question:

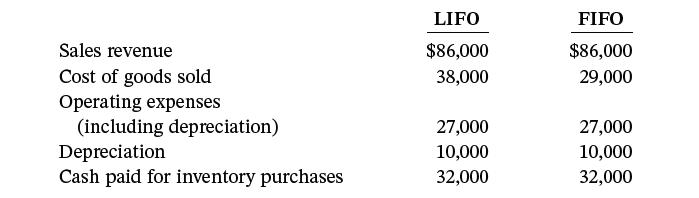

The following comparative information is available for Rose Company for 2025.

Instructionsa. Determine net income under each approach. Assume a 20% tax rate.b. Determine net cash provided by operating activities under each approach. Assume that all sales were on a cash basis and that income taxes and operating expenses, other than depreciation, were on a cash basis.c. Calculate the quality of earnings ratio under each approach and explain your findings. (Round answer to two decimal places.)

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Accounting Tools For Business Decision Making

ISBN: 9781119791058

8th Edition

Authors: Paul D. Kimmel, Jerry J. Weygandt, Jill E. Mitchell

Question Posted: