VBD has started a home delivery business that buys items at wholesale prices and sells them to

Question:

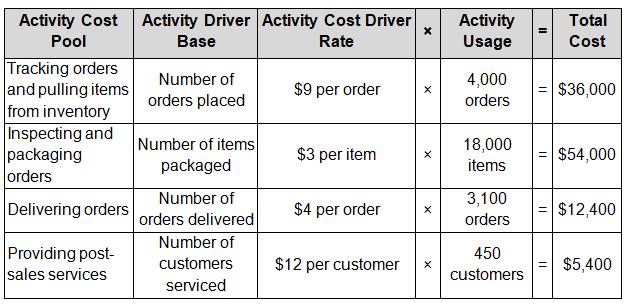

VBD has started a home delivery business that buys items at wholesale prices and sells them to customers at retail prices. The owner has identified several key indirect cost activities for its distribution center, the cost driver rate per activity, and the activity usage for the month, as follows:

Distribution center activities include all of the above except providing post-sales services. Total cost is $102,400 ($36,000 + $54,000 + $12,400).

a. What is the total indirect cost assigned to the distribution center?

b. Currently, all of the costs are added and assigned to the products based on the total number of orders placed for the month. Which benefits can be gained by assigning costs using the ABC analysis? Be specific.

c. Do you agree with the activity cost drivers chosen? Should the company use time-based drivers for any of the activities? What if the items vary in weight or their need for special handling?

d. The company is concerned with the costs associated with tracking the usage versus the benefits from the information gathered. As such, for the post-sales service activity, all customers with issues were lumped together. Do you think that changes, returns, and collections warrant further breakdown? Discuss.

e. Management is interested in ranking the previously mentioned activities with respect to “value added.” What would be your ranking of the activities from most value-added to least value-added?

f. Management has concluded that post-sales service is the primary activity candidate for improvement. How could the company reduce the post-sales service costs? What additional customer information would be useful?

g. Would it be useful to present this information in a visual format (e.g., bar graph, pie chart)? Explain.

Step by Step Answer:

Managerial Accounting

ISBN: 9780137689453

1st Edition

Authors: Jennifer Cainas, Celina J. Jozsi, Kelly Richmond Pope