Question: Wallace. Inc., develops software for Internet applications. The market is very competitive. Wallace offers a wide variety of different softwarefrom simple programs that enable new

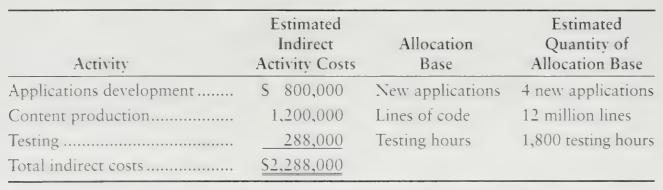

Wallace. Inc., develops software for Internet applications. The market is very competitive. Wallace offers a wide variety of different softwarefrom simple programs that enable new users to create personal Web pages (called Personal-Page), to complex commercial search engines (called Hi-Secure). The company's managers know they need accurate product-cost data. Then have dereloped the following information to determine if an activity-based costing system would be beneficial.

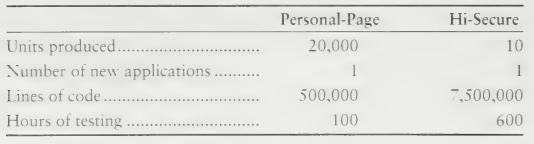

Other production information for Personal-Page and Hi-Secure includes:

Requirements

1. Compute the cost allocation rate for each activity. Carry each cost to the nearest cent.

2. Use the activity-based cost allocation rates to compute the activity costs per unit of Personal-Page and Hi-Secure. First compute the total activity costs allocated to each product line, and then compute the cost per unit.

3. Wallace's original single-allocation-base costing system allocated indirect costs to products at \(\$ 50\) per programmer hour. PersonalPage requires 10,000 programmer hours; Hi-Secure requires 15,000 programmer hours. Compute the total indirect costs allocated to Personal-Page and Hi-Secure under the original system. Then compute the indirect cost per unit for each product.

4. Compare the activity-based costs per unit to the costs from the single-allocation-base system. How have the unit costs changed? Explain why the costs changed as they did.

Estimated Indirect Activity Costs Activity Applications development.......... $ 800,000 Allocation Base New applications Estimated Quantity of Allocation Base 4 new applications Content production............ 1,200,000 Lines of code 12 million lines Testing..... 288,000 Testing hours 1,800 testing hours Total indirect costs. $2.288,000

Step by Step Solution

3.45 Rating (152 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts