Custy Canoe and Kayak, Inc., is considering investing in a facility that would allow it to manu

Question:

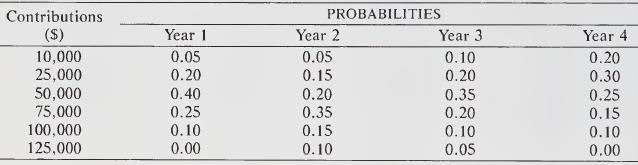

Custy Canoe and Kayak, Inc., is considering investing in a facility that would allow it to manu¬ facture lightweight fiberglass sports kayaks. The proposed plant would involve an initial invest¬ ment of $212,500 and would have an expected life of four years, after which time its expected scrap value would be $12,500. The marketing manager, Maureen Custy, expects these kayaks to become increasingly popular in future years, although other firms are likely to begin supplying competitive canoes within two or three years. Extensive market research and cost estimation studies have established the following (independent) probability distributions of the level of contribution to overheads and profits in each of the four years.

Note that the contribution figures do not include consideration of the tax savings result¬ ing from depreciation. For tax purposes, depreciation is calculated using the sum-of-years-dig- its method. The finance manager, Michael Gable, advises that the applicable tax rate is 48 percent, and that this project should be evaluated in terms of the alternative use of these funds to establish a camping resort area for canoe enthusiasts, which he considers to be of equal risk. The resort project has an expected internal rate of return of 15 percent.

Assume that the kayak plant can be purchased and installed at the start of this year, that tax payments or refunds are due at the end of each year, that the profit contributions are re¬ ceived continuously throughout each year, and that the expected scrap value is realized at the end of the fourth year.

(a) Calculate the expected net present value of the kayak project, taking care to use the appro¬ priate discount factors.

(b) Find the approximate internal rate of return of the kayak project.

(c) Recalculate the expected net present value of the kayak project, assuming this time that all cash flows take place in lump sum at the start or end of each year.

(d) Explain why there is a difference between your answers to

(a) and (c).

(e) In which project (kayak or resort) should Custy Canoe and Kayak invest the funds? Ex¬ plain.

Step by Step Answer: