The Anderson Electronics Company is considering investing $1 million in a major advertising campaign. This expenditure will

Question:

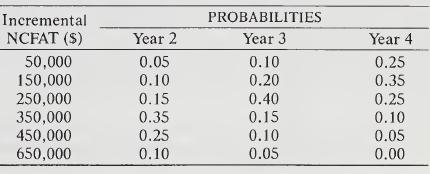

The Anderson Electronics Company is considering investing $1 million in a major advertising campaign. This expenditure will be tax deductible at the end of the year in which it is incurred, and Anderson’s tax rate is 48 percent. It will take a year to produce the campaign after the million dollars is spent, and the impact of the campaign on sales is expected to be felt over the following three years. The precise outcomes are uncertain, however. The marketing research department has generated the following estimates (and associated probabilities) of incremental net cash flows after taxes that will result from this campaign for each of the three years.

The probability distributions should be treated as being independent from year to year (hence no conditional probabilities), and the NCFAT figures should be regarded as arriving at the end of each year. Anderson considers this project to be about as risky as investing the funds in the bonds of a large trust company which would currently pay 12 percent per annum. Assume that Anderson’s tax assessment will be finalized one year after the million is spent.

(a) What is the net present value of this investment project?

(b) What is the internal rate of return of the project?

(c) Sketch the NPV curve against various opportunity discount rates and estimate from this the NPV if the appropriate discount rate is 10 percent.

Step by Step Answer: