Marilyn Monibaggs is considering investing in a small shop in the downtown area of a large city.

Question:

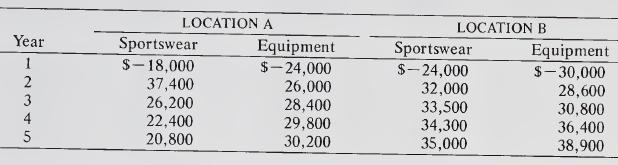

Marilyn Monibaggs is considering investing in a small shop in the downtown area of a large city. Ms. Monibaggs has not been lax in her investigations but has found that only two locations are feasible. Ms. Monibaggs is considering establishing either a sportswear boutique or a sporting equipment store, and she could put either type of store at either location. Location A is initially more suitable for the sportswear boutique, but the profitability of this venture will decline in the uture because of the planned establishment of a major department store and other shops nearby After this event the sporting equipment shop would be more profitable than the sports¬ wear shop at this location. Location B, on the other hand, is close to several competitors in both types of merchandise but is frequented by a larger number of potential customers. The initial cash outlay will be $50,000 for the sportswear store versus $60,000 for the equipment store, and Ms Monibaggs will pay a monthly lease on the location chosen. The cash flows after taxes for each of the four alternatives have been carefully estimated as follows:

These figures include the initial cash outlay for inventories that was incurred at the start of the first year. Treat the other net cash flows as arriving in a continuous stream throughout each year. Ms. Monibaggs, is only interested in a time horizon of five years and considers the opportunity discount rates to be 14 percent and 15 percent for the sportswear and equipment stores, respectively, at location A; and 17 percent and 20 percent for the sportswear and equip¬ ment stores, respectively, at location B.

(a) What is the net present value of each of the four projects9

(b) Estimate the payback period for each of the four projects.

(c) Supposing Ms. Monibaggs is interested in maximizing her net worth but at the same time wants to get her (undiscounted) money back quickly in order to be ready to invest elsewhere if an opportunity arises, which alternative should she choose? Explain.

Step by Step Answer: