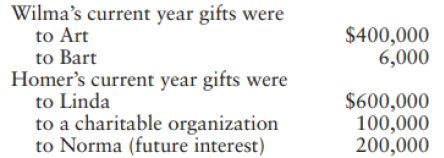

In 2018, Homer and his wife, Wilma (residents of a noncommunity property state) make the gifts listed

Question:

In 2018, Homer and his wife, Wilma (residents of a noncommunity property state) make the gifts listed below. Homer's previous taxable gifts consist of $100,000 made in 1975 and $1.4 million made in 1996. Wilma has made no previous taxable gifts.

a. What are the gift tax liabilities of Homer and Wilma for 2018 if they elect gift splitting and everyone except Norma receives a present interest?

b. How would the gift tax liabilities for each spouse in Part a change if they do not elect gift splitting?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Global Taxation How Modern Taxes Conquered The World

ISBN: 9780192897572

1st Edition

Authors: Philipp Genschel, Laura Seelkopf

Question Posted: