Consider a chooser option that entitles the holder to choose, on the choice date T c periods

Question:

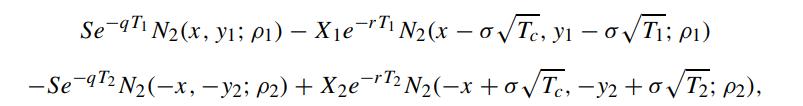

Consider a chooser option that entitles the holder to choose, on the choice date Tc periods from now, whether the option is a European call with exercise price X1 and time to expiration T1 − Tc or a European put with exercise price X2 and time to expiration T2 − Tc. Show that the price of the chooser option at the current time (taken to be time zero) is given by (Rubinstein, 1992)

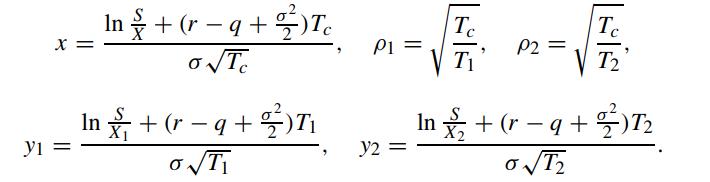

where q is the continuous dividend yield of the underlying asset. The parameters are defined by

where q is the continuous dividend yield of the underlying asset. The parameters are defined by

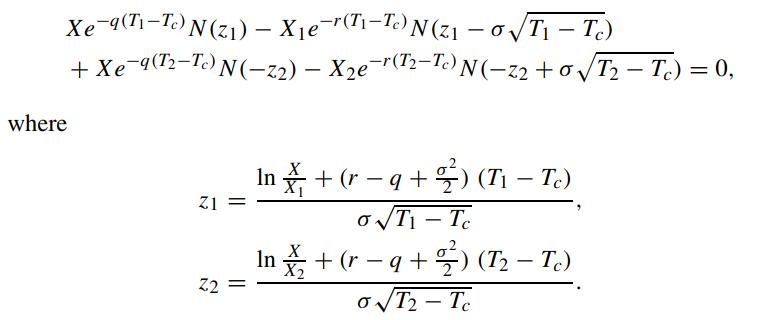

Here, X solves the following nonlinear algebraic equation

The two overlapping standard Brownian increments Z(Tc) and Z(T1) have the joint normal distribution with zero means, unit variances and correlation coefficient ![]()

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: