Consider a portfolio containing t units of the risky asset and M t dollars of the

Question:

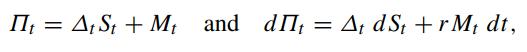

Consider a portfolio containing Δt units of the risky asset and Mt dollars of the riskless asset in the form of a money market account. The portfolio is dynamically adjusted so as to replicate an option. Let St and V (St,t) denote the price process of the underlying asset and the option value, respectively. Let r denote the riskless interest rate and Πt denote the value of the self-financing replicating portfolio. When the self-financing trading strategy is adopted, we obtain

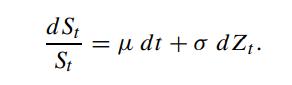

where r is the riskless interest rate. Explain why the differential term St dΔt does not appear in dΠt . The asset price dynamics is assumed to follow the Geometric Brownian process:

where r is the riskless interest rate. Explain why the differential term St dΔt does not appear in dΠt . The asset price dynamics is assumed to follow the Geometric Brownian process:

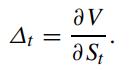

In order that the option value and the value of the replicating portfolio match at all times, show that the number of units of asset held is given by

In order that the option value and the value of the replicating portfolio match at all times, show that the number of units of asset held is given by

How should we proceed in order to obtain the Black–Scholes equation for V ?

Step by Step Answer: