From the put-call symmetry relation for the prices of American call and put options derived in Problem

Question:

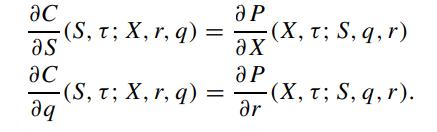

From the put-call symmetry relation for the prices of American call and put options derived in Problem 5.7, show that

Give financial interpretation of the results.

Problem 5.7

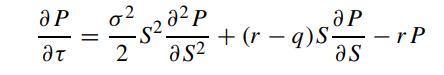

Let P(S,τ ; X,r,q) denote the price function of an American put option. Show that P(X,τ ; S,q,r) also satisfies the Black–Scholes equation:

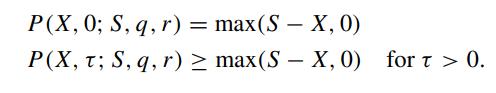

together with the auxiliary conditions:

Note that the auxiliary conditions are identical to those of the price function of the American call option. Hence, we can conclude that

![1 P ( 13 1: 7, 9, 1) = X PCX T; SX Write P (S', T) = P that 02 -[SXP (S', T)] - a T as2 [SXP (S', T)] - (r](https://dsd5zvtm8ll6.cloudfront.net/images/question_images/1700/5/4/6/207655c469fbddb71700546202712.jpg)

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: