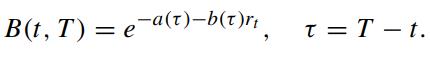

Under the risk neutral measure Q, assume that the bond price B(t,T) is related to the short

Question:

Under the risk neutral measure Q, assume that the bond price B(t,T) is related to the short rate rt by

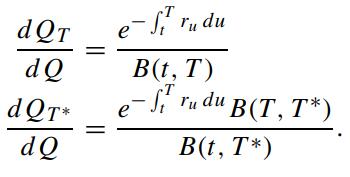

Define the following probability measures QT and QT∗ , where

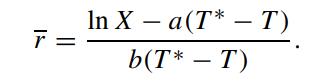

Consider a European call option on the T∗-maturity discount bond B(t,T∗) maturing at time T,T ∗. Let X be the strike price of the bond option and define

Conditional on rt = r, show that the price of the bond option is given by

Conditional on rt = r, show that the price of the bond option is given by

![]()

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: